Trade War

Trump's Reform of the US-Led International Trade/Economic System

REPORTS & ANALYSIS

VIDEO REPORTS

TRADE BALANCE (USD Billions) MAP (OF EACH RESPECTIVE COUNTRY)

The above is an estimation based on information we are collect from open source intelligence and news reporting. We are not responsible for any mishap, misjudgment or losses resulted in the usage of the information presented in this map.

US TRADE BALANCE (USD Billions)

The above is an estimation based on information we are collect from open source intelligence and news reporting. We are not responsible for any mishap, misjudgment or losses resulted in the usage of the information presented in this map.

CURRENT "TRADE WAR" TARIFFS

latest tariff by Usa

China 145% >>> 10% (12 May 2025)

Canada 25% for non-USMCA

Mexico 25% for non-USMCA

European Union 10% until 8 July 2025

Countries tariffed above 10% 10% until 8 July 2025

Other countries 10%

latest retaliatory tariff on Usa

China 125% >>> 10% (from 12 May 2025)

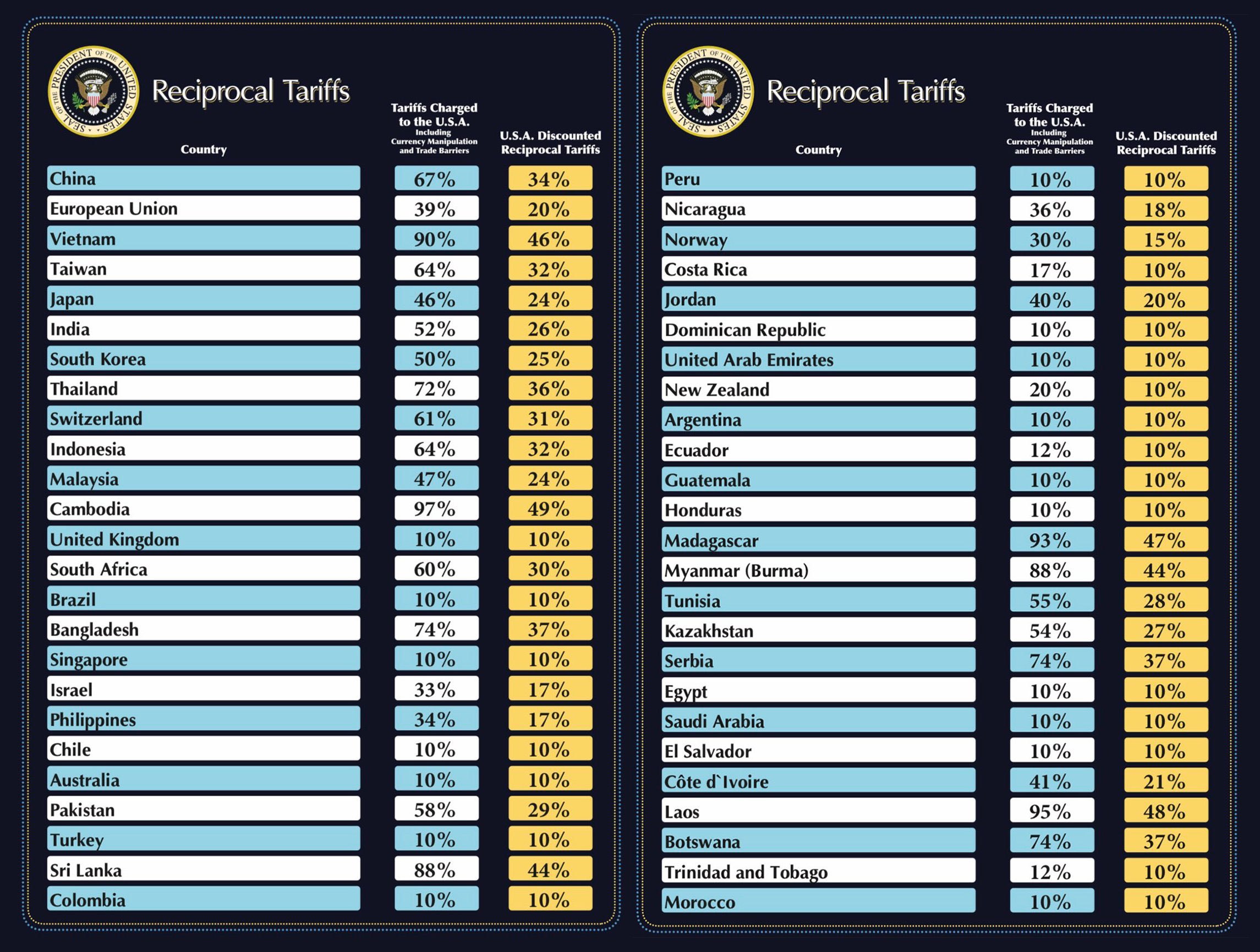

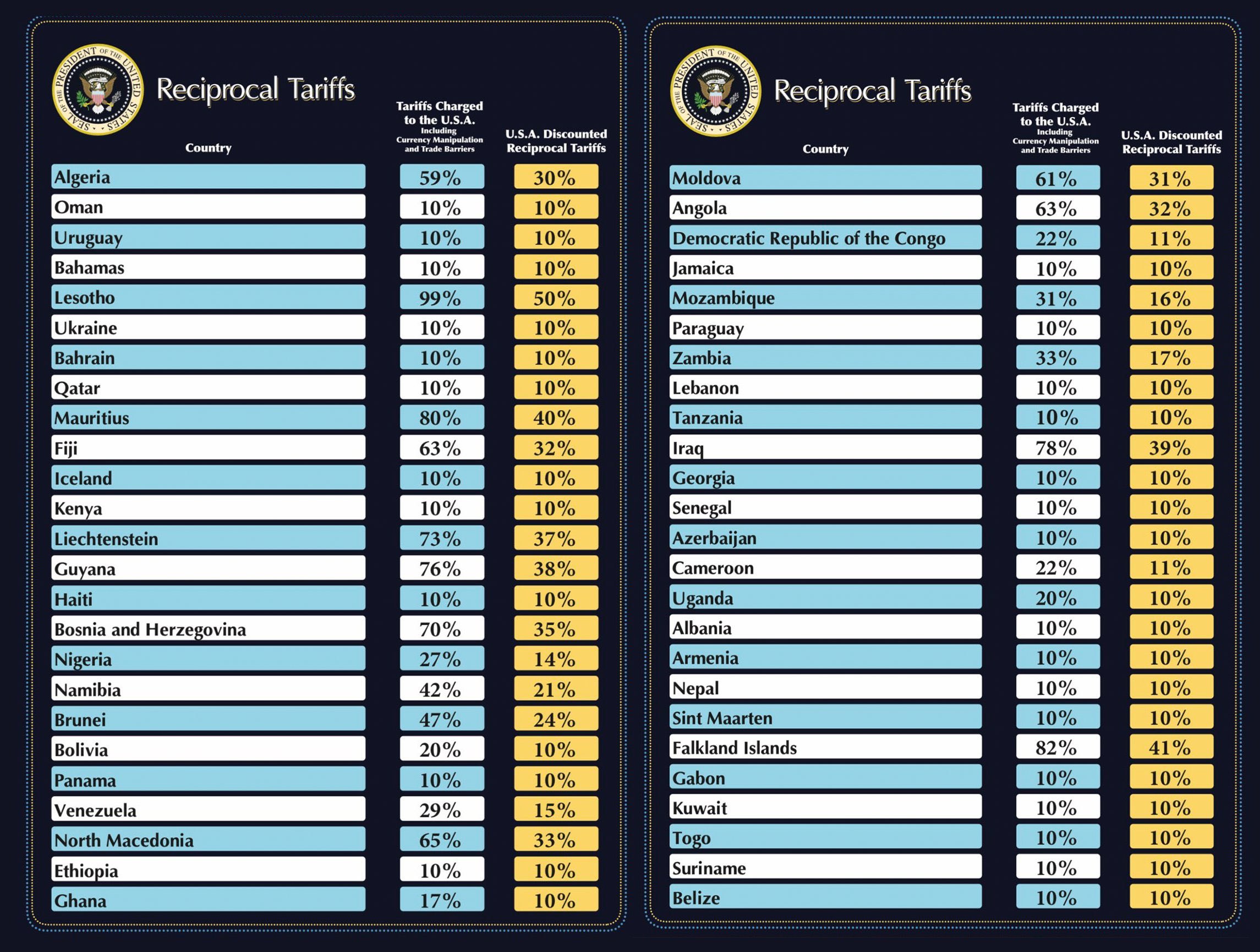

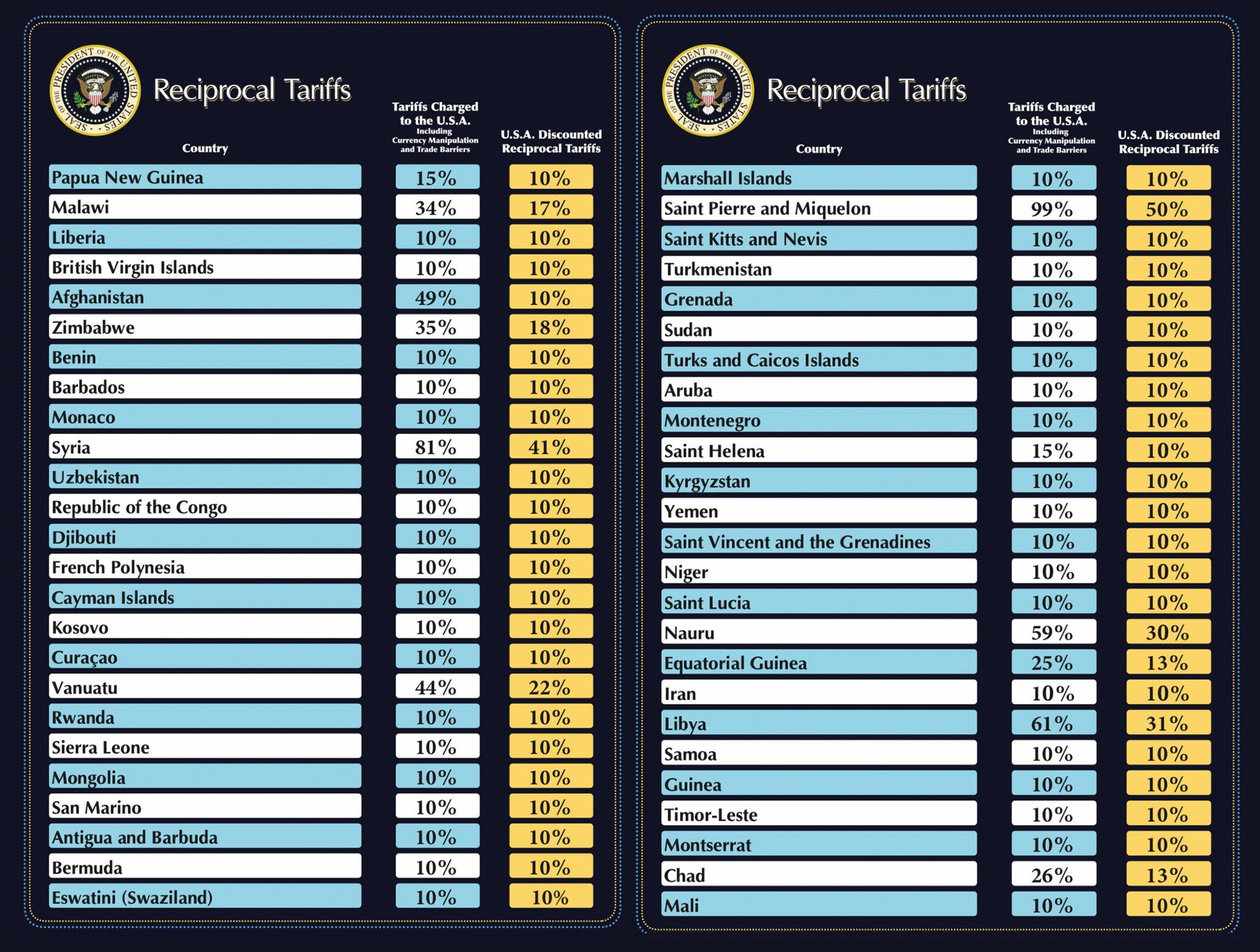

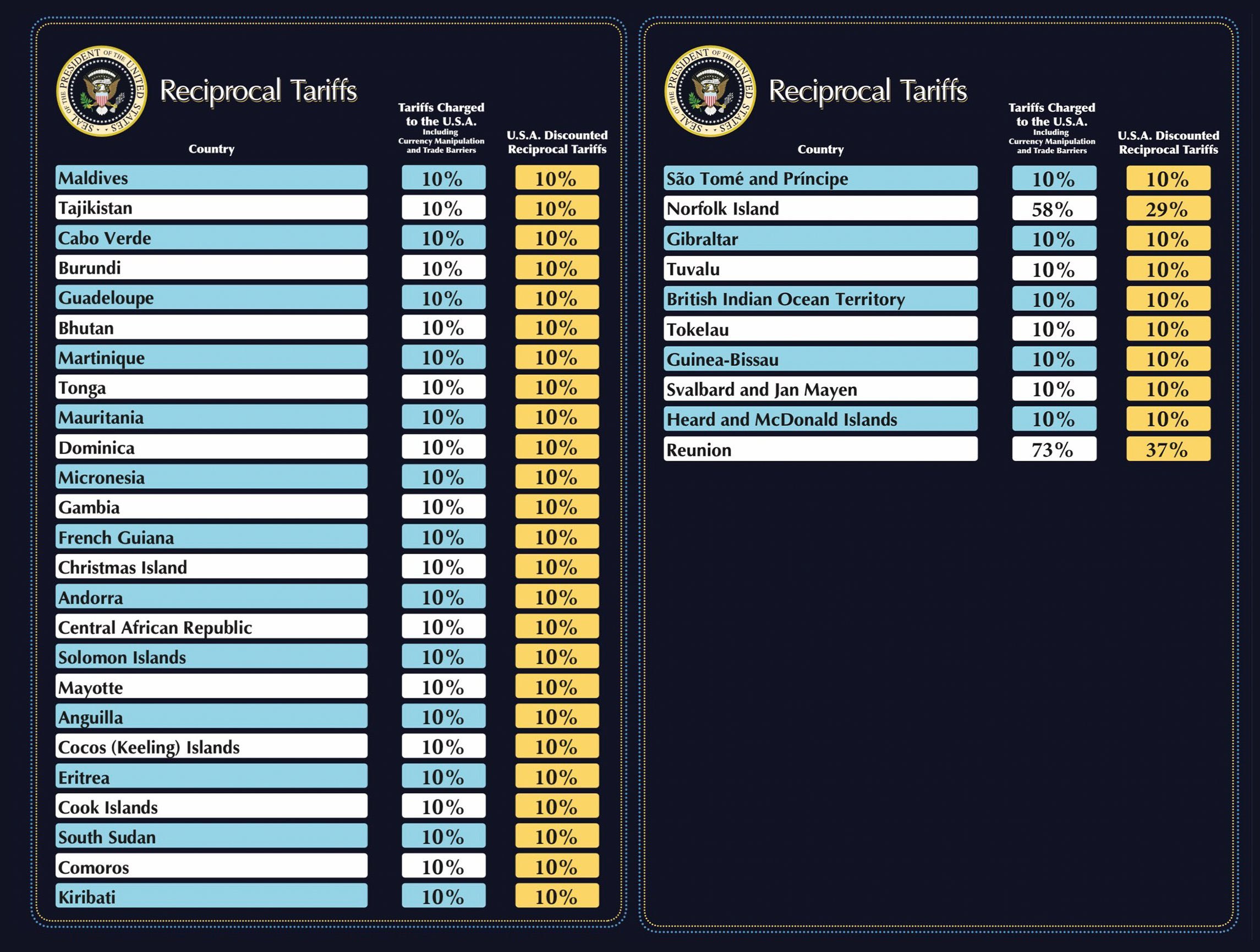

US RECIPROCAL TARIFF (2 APRIL 2025)

US VS CHINA MATCH UP

Agreed Trade deals with usa

May 9, 2025 - United Kingdom: 10% baseline tariff kept on British products imported to the United States. The agreement lowers 25% universal tariffs on automobiles from the UK to 10%, while the 25% rate still applies to vehicles from other countries. Trump also agreed to eliminate 25% tariffs on steel from the UK. Other details are still in the works.

Offers to USA in Negotiations

April 1, 2025 - Israel: Proposing new trade agreements by eliminating tariffs on U.S. goods, effective April 1, 2025; Prime Minister Benjamin Netanyahu’s push aligns with White House praise from April 8–10, 2025.

April 2, 2025 - Canada: Secured a tariff delay until April 2, 2025 under the USMCA; offering cooperation on fentanyl and trade imbalances, with talks continuing on April 10, 2025 following tariff announcements on April 7, 2025.

April 2, 2025 - Mexico: Under a tariff delay until April 2, 2025 via the USMCA; proposing drug trafficking measures, with negotiations ongoing on April 10, 2025 in response to tariff policy effective April 7, 2025.

April 4, 2025 - Vietnam: Offering zero tariffs on all U.S. goods; Vietnam's leader To Lam proposed this during a call with Trump, with delegations rushing to Washington by April 10, 2025 to finalize terms.

May 9, 2025 - Vietnam:Vietnam had lowered tariffs on American cherries, apples and almonds, all important exports for the country’s western states, confirmed by USA.

April 6, 2025 - Taiwan: Offering zero tariffs on U.S. goods, proposed by April 6, 2025; negotiations ongoing by April 10, 2025 in response to tariff escalation starting April 7, 2025.

April 7, 2025 - India: Open to slashing tariffs on U.S. imports worth $23 billion; negotiations started among the 75+ countries contacting the U.S. since Trump’s tariff policy took effect, continuing into April 10, 2025.

April 8, 2025 - South Korea: Expected to propose tariff cuts and investments (e.g., Hyundai’s $21 billion U.S. plan); Trade Minister Cheong In-kyo met U.S. officials on April 8–9, 2025, with talks ongoing by April 10, 2025.

April 7, 2025 - European Union: Signaling openness to negotiations, offering a "zero-for-zero" tariff deal; counter-tariffs on $28 billion of U.S. goods set for April 15, 2025, in response to U.S. steel tariffs, with talks ongoing since April 7, 2025.

USA Negotiations

April 17, 2025 - Italy: Italian Prime Minister Giorgia Meloni met Trump at the white house. Trump stated he was “100% certain” of a future trade deal with Europe, while Meloni emphasized a “zero-for-zero” tariff approach to avoid a trade war. Meloni invited Trump to visit Italy, which he accepted, but no timeline was set. Conclusion: No deal, waiting for EU-US negotiation.

April 16-17, 2025 - Japan: Japan visits White House. Trump signals he will be negotiating tariff, cost of military support and trade fairness. Japan signals they will not be pressured into unjust trade deals, seeking fairness and diplomacy. Conclusion: No deal, to meet again in late April 2025.

April 9-10, 2025 - Vietnam: Vietnamese Deputy Prime Minister Ho Duc Phoc is on a working trip to the U.S. for tariff-related negotiations, and is expected to meet with Treasury Secretary Scott Bessent.

April 10-12, 2025 - China: Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer will meet in Geneva with a Chinese delegation led by Vice Premier He Lifeng. Both sides agree to remove tariffs and restrictions since "Liberation Day" for 90 Days. De Minimis duties remained, but reduced.

China Counter Negotiations

April 11, 2025 - Spain: Spanish Prime Minister Pedro Sanchez visits China as the EU rethinks its trade ties following new US import tariffs that have shaken global markets. During his meeting with Spanish Prime Minister Pedro Sanchez, Xi said China and the EU should cooperate more closely to deal with the growing trade tensions between Beijing and Washington

April 14-18, 2025 - Vietnam, Malaysia Cambodia: President Xi Jinping will visit three Southeast Asian countries next week, as China steps up efforts to court partners to buffer the economy against an escalating trade war with the US.

Specific Goods Targeted by Section 301 Tariffs on China

Electronics and Semiconductors:

Semiconductors: 50% tariff effective January 1, 2025 (up from 25% in some cases). Covers 16 tariff categories to support U.S. semiconductor investments under the CHIPS Act.

Wafers for Semiconductor Manufacturing: Proposed 50% tariff (HTS 3818.00.00), as China accounts for 95% of global wafer capacity.

Consumer Electronics: Includes laptops, monitors, smartphones, and video game consoles, many of which have faced tariffs since 2018 but were spared higher rates to avoid consumer price spikes.

Tariff Exclusions: Smartphones, computers, and certain electronics were granted exclusions from the 125% reciprocal tariffs announced in April 2025, sparing them from the steepest duties.

-

Electric Vehicles (EVs) and Batteries:

Electric Vehicles: 100% tariff effective September 27, 2024, to protect U.S. EV manufacturers.

EV Batteries and Battery Parts: 25%–50% tariffs, with some increases phased in for 2025–2026.

Lithium-Ion Non-EV Batteries: Tariff increases planned for 2025–2026 to reduce reliance on Chinese supply chains.

Permanent Magnets: 25% tariff (HTS 8505.11.00), critical for EV motors and defense applications, effective September 2024.

-

Solar Products:

Solar Cells and Modules: 50% tariff effective September 27, 2024, to bolster U.S. solar manufacturing.

Solar Wafers and Polysilicon: Existing 25% tariff increased to 50% effective January 1, 2025, to counter China's dominance in solar supply chains.

Solar Manufacturing Equipment: 14 product-specific exclusions (HTS 8486.10.0000, 8486.20.0000, 8486.40.0030) retroactive from January 1, 2024, to May 31, 2025, to support U.S. solar production. Five proposed exclusions were removed as equipment is available outside China.

Steel and Aluminum Products:

Steel and Aluminum: 25% tariff effective September 27, 2024, building on existing Section 232 tariffs to protect U.S. industries.

Exclusions: Goods already subject to Section 232 tariffs are exempt from the 125% reciprocal tariffs imposed in April 2025.

-

Medical Supplies:

Respirators and Facemasks: 25%–50% tariffs, with increases effective September 27, 2024.

Syringes and Needles: 50% tariff effective September 27, 2024; enteral syringes excluded.

Medical Gloves: Tariff increases planned for 2025–2026.

COVID-Related Exclusions: 77 exclusions for medical products were extended through May 31, 2025, to address supply needs.

-

Critical Minerals and Tungsten:

Critical Minerals: 25% tariff effective September 27, 2024, to reduce U.S. dependence on Chinese minerals.

Tungsten Products: 25% tariff effective January 1, 2025, for products not previously subject to Section 301 tariffs.

Rare Earths: While not explicitly listed in recent updates, China's export restrictions on gallium and germanium highlight their strategic importance, potentially prompting further U.S. tariff actions. [From user's initial request]

-

Machinery and Industrial Goods:

Ship-to-Shore Gantry Cranes: 25% tariff effective September 27, 2024; cranes ordered before May 14, 2024, are excluded.

Machinery for Domestic Manufacturing: Temporary exclusions proposed for 312 HTS subheadings under Chapters 84 and 85, with five additional subheadings added in September 2024. Exclusions are effective through May 31, 2025.

General Industrial Goods: Includes electronics, machinery, furniture, toys, and plastics, with tariffs ranging from 7.5% to 25% since 2018. An additional 10% tariff was proposed in 2025, potentially increasing to 20% or higher if China's Most Favored Nation status is revoked.

-

Apparel, Footwear, and Textiles:

Apparel and Footwear: Subject to tariffs up to 100%, compounded by additional 125% reciprocal tariffs and 20% fentanyl-related tariffs, resulting in effective rates as high as 245% for some goods.

Textiles: Included in List 4A with 7.5% tariffs, with potential increases under new proposals.

SITUATION OVERVIEW

TRADE WARS

USA vs China (ongoing)

China vs European Union (brewing)

USA vs European Union (on temp. hold)

USA vs Canada (on temp. hold)

USA vs Mexico (on temp. hold)

BREWING TRADE TENSION

China vs Japan

China vs South Korea

China vs Australia

China vs Brazil

China vs India

China vs Vietnam

DEMANDS (as of 1 April 2025)

- Reduction of Trade Deficits:

The U.S. seeks to decrease its trade deficits with multiple countries by encouraging increased imports of American goods and services. - Elimination of Non-Tariff Barriers: Beyond tariffs, the U.S. has expressed concerns about non-tariff barriers that hinder American exports. These include foreign regulations, standards, and practices that may disadvantage U.S. products. The administration has sought changes in areas such as value-added taxes (VAT), food safety regulations, and currency valuations to ensure a level playing field for American businesses.

- Addressing Currency Manipulation: The U.S. has raised concerns about countries potentially devaluing their currencies to gain unfair trade advantages. By addressing such practices, the administration seeks to promote fair competition in international markets.

- Reciprocal Tariffs: The U.S. aims to implement tariffs that mirror those imposed by other countries, advocating for "reciprocal" trade relationships. This approach is intended to pressure trading partners into reducing their tariffs and trade barriers to match U.S. levels.

KEYSTONE DEVELOPMENT (9 May 2025)

President Donald Trump said that the U.S. will maintain a baseline 10% tariff on imports even after trade deals are struck, adding there could be exemptions when countries offer significant trade terms.

DEVELOPMENT (16 May 2025)

Moody’s had been a holdout in keeping U.S. sovereign debt at the highest credit rating possible, and brings the 116-year-old agency into line with its rivals. Standard & Poor’s downgraded the U.S. to AA+ from AAA in August 2011, and Fitch Ratings also cut the U.S. rating to AA+ from AAA, in August 2023.

The U.S. lost its perfect AAA rating from all three major agencies (S&P, Moody’s, Fitch) for the first time in over a century, with Moody’s downgrade in May 2025 marking the final shift.

“Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” Moody’s analysts said in a statement.“We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

"The US' long-term local- and foreign-currency country ceilings remain at Aaa."

Read Moody's full Press Release: https://ratings.moodys.com/ratings-news/443154

DEVELOPMENT (13 May 2025)

Consumer prices climbed last month at the slowest pace since February 2021, as the inflationary effects of President Donald Trump's tariffs had yet to hit Americans' wallets.

Analysts said the slower price growth may still not prompt the Federal Reserve, which is tasked with managing inflation, from lowering interest rates. Trump has repeatedly called for the central bank to do so, bashing its decision last week to hold rates steady.

KEYSTONE DEVELOPMENT (9 May 2025)

Agreement in principle provides significant expansion in U.S. market access in the UK, with reduction in tariff for UK automobiles, steel and aluminum.

- negotiate a digital trade provisions

- secures the supply chain of U.S. aerospace manufacturers through preferential access to high-quality UK aerospace components.

- secure supply chain for pharmaceutical products.

- close loopholes in the UK’s government procurement market that harm U.S. and UK firms.

- give each other preferential procurement access to which other countries are not entitled.

- US tariffs on automotives immediately slashed from 27.5% to 10%: first 100,000 vehicles imported into the United States by UK car manufacturers each year are subject to an all-in rate of 10% and any additional vehicles each year are subject to 25% rates on top of the Most Favored Nation tariff. Quota is almost the total the UK exported in 2024.

- Negotiate an alternative arrangement to USA's Section 232 tariffs on steel and aluminum: effectively reduced to zero

- Reciprocal market access on beef – with UK farmers given a quota for 13,000 metric tonnes.

USA however is disappointed that UK refused to remove the Digital Services Tax (DST).

KEYSTONE DEVELOPMENT

Federal Register filings reveal probes into imports of pharmaceuticals and semiconductors as part of a bid to impose tariffs on both sectors on grounds that extensive reliance on foreign production of medicine and chips is a national security threat.

The filings announce 21-day public comment periods and mark President Donald Trump's latest use of Section 232 of the Trade Expansion Act of 1962 as justification for so-called sectoral tariffs aimed at boosting domestic production of goods he says are critical to national security.

Using the 232 provision, the Trump administration has started investigations into imports of copper and lumber, and probes completed during Trump's first term formed the basis for 25% tariffs rolled out since his return to the White House in January on steel and aluminum and on the auto industry.

The filings, which indicate the administration began the investigations on April 1, follow exclusions unveiled over the weekend for smartphones, computers and other electronics imported largely from China from Trump's steep 125% reciprocal duties. Trump officials had said those products would soon be subject to Section 232 tariffs.

Section 232 probes need to be completed within 270 days of their initiation. (source)

Foreshadowing of future actions

"All those products are going to come under semiconductors, and they're going to have a special focus type of tariff to make sure that those products get reshored.

We need to have semiconductors, we need to have chips, and we need to have flat panels -- we need to have these things made in America. We can't be reliant on Southeast Asia for all of the things that operate for us

So what [President Donald Trump's] doing is he's saying they're exempt from the reciprocal tariffs, but they're included in the semiconductor tariffs, which are coming in probably a month or two. So these are coming soon."

United States of America

... told ABC News, the exemptions for electronics are only a temporary reprieve. Those products will face separate levies

This, he stressed, would not only “safeguard their own legitimate rights and interests, but also… safeguard international fairness and justice.”

KEYSTONE DEVELOPMENT (5 May 2025)

Malaysia’s Ministry of Investment, Trade and Industry (Miti) announced on May 5 that with effect from May 6, it will be the only body that will issue non-preferential certificates of origin (NPCOs) for shipments to the US, stopping the issuance of these certificates by Miti-appointed organisations like local business councils, chambers or associations.

The NPCO is a document that helps to identify the origin of goods for international shipments in order to satisfy Customs or trade requirements of the countries the products are shipped to, the Federation of Malaysian Manufacturers said on its website.The government’s new measure aims to eliminate loopholes that could enable the misuse of Malaysia as a conduit for goods seeking to bypass tariffs imposed by US trade regulations. Miti said in its statement that “it is unequivocally committed to upholding the integrity of international trade practices”.

“As such, the government views any attempt to circumvent tariffs through wrong or false declaration, whether related to the value or origin of goods, as a serious offence,” it added.

Addressing the matter in Parliament on May 5, Investment, Trade and Industry Minister Tengku Zafrul Aziz said: “For countries with no free trade agreements with Malaysia, like the US, we have an NPCO which is issued by business chambers, but due to this (trans-shipment) issue, Miti will take over the issuance of these certificates.”

He added that Malaysia has received “many complaints from industry partners” that “many items coming from other countries are stamped as if they come from our country”.

KEYSTONE DEVELOPMENT

India and the US have finalised the terms of reference outlining the roadmap for negotiations of the proposed Bilateral Trade Agreement (BTA), according to a statement issued by the US.

US Trade Representative (USTR) Jamieson Greer said that these ongoing talks will help achieve balance and reciprocity by opening new markets for American goods and addressing unfair practices that harm US workers.

"India's constructive engagement so far has been welcomed, and I look forward to creating new opportunities for workers, farmers, and entrepreneurs in both countries," he said in a statement.

"I am pleased to confirm that USTR and India's Ministry of Commerce and Industry have finalised the Terms of Reference to lay down a roadmap for the negotiations on reciprocal trade," Ambassador Greer said.

KEYSTONE DEVELOPMENT

The U.S. Department of Commerce (DOC) concluded a trade probe that began a year ago when several major solar equipment producers asked the administration of then-President Joe Biden to protect their US operations.

A separate US government agency, the International Trade Commission, is due to reach a final decision on the new tariffs in June.

The probe targeted crystalline silicon photovoltaic (PV) cells and modules, key components of solar panels, exported from these Southeast Asian countries, which account for a significant share of U.S. solar imports.

Findings confirmed subsidies (e.g., tax breaks, low-cost loans) and dumping margins, justifying anti-dumping (AD) and countervailing duties (CVD) to level the playing field for U.S. producers.

Cambodia: Faces the highest duties at up to 3,521%, effectively blocking most solar exports to the U.S. This rate reflects the DOC’s calculation of severe dumping and subsidy levels, likely tied to specific Cambodian firms or supply chains linked to Chinese manufacturers.

Vietnam: Duties up to 395.9%, targeting major exporters like Trina Solar and JinkoSolar, which have production facilities in Vietnam. The high rate aims to curb Vietnam’s role as a transshipment hub for Chinese solar components.

Thailand: Duties up to 375.2%, impacting firms like Canadian Solar operating in Thailand. The rate reflects significant dumping margins and subsidies, though lower than Cambodia and Vietnam.

Malaysia: Lowest duties at up to 34.4%, affecting companies like First Solar. Malaysia’s lower rate suggests less aggressive subsidy or dumping practices compared to its neighbors.

Duties vary by company and product, with preliminary rates subject to final DOC review in mid-2025. Rates are applied to the import value, drastically raising costs for U.S. importers.

Point of view

"At the end of the day that we can probably reach a deal with our allies... and then we can approach China as a group."

United States of America

... spoke with investors Tuesday morning at a summit hosted by the American Bankers Association, warning Spain and any other countries from thinking that aligning themselves with China is a solution against the United States.

USA vs china (2025)

January 20, 2025: Trump begins his second term. Tariffs on Chinese imports are raised to 20% early in the administration.

February 4, 2025: Trump signs executive orders imposing additional tariffs, including 10% on all Chinese imports (later escalated). China responds with 15% tariffs on U.S. coal and liquefied natural gas, and 10% on crude oil and agricultural machinery.

March 4, 2025: Trump doubles tariffs on Chinese imports to 20%. China retaliates with 15% tariffs on U.S. farm products like chicken, pork, and soybeans.

April 2, 2025: U.S. President Donald Trump announces a significant escalation, raising tariffs on all Chinese imports by an additional 34%, bringing the total tariff rate to 54% (stacked on top of the 20% imposed earlier in 2025). Dubbed "Liberation Day" by Trump, this move is framed as a reciprocal response to alleged Chinese trade barriers. China vows retaliation, signaling no intent to back down.

Trump announced proper protocol was in place to collect revenue on small-value packages sent through the international postal network. From May 2nd, Postal packages from China valued at under $800 will then be taxed at 90% of their value or $75 per item, which is scheduled to increase to $150 per item after June 1.

April 4, 2025: China responds with its own 34% tariffs on all U.S. imports, effective April 10, matching the U.S. escalation. Beijing also imposes export restrictions on rare earth elements critical for tech and defense industries, bans several U.S. companies from operating in China, and launches trade investigations into American exports like medical imaging equipment.

April 7, 2025: Trump threatens an additional 50% tariff on Chinese goods, to take effect April 9, unless China withdraws its 34% retaliatory tariffs by April 8. China’s Ministry of Commerce declares it will "fight to the end," rejecting the ultimatum and accusing the U.S. of economic bullying. Global markets react with sharp declines, with the S&P 500 dropping over 9% for the week.

April 9, 2025: The U.S. implements the additional 50% tariff as promised, raising the total tariff rate on Chinese imports to 104% (20% from February, 34% from April 2, plus 50% today). This marks the highest tariff level in modern U.S.-China trade history.

China in response had also raised another 50% tariff, mirroring US tariff action, increasing retaliatory tariff from 34% to 84%

Trump immediately counter attacked on China’s increase of retaliatory tariff to 84% with an immediate increase of tariff on China to 125% on the same day.

While at the same time, Trump, upon achieving the goal of getting countries onto the negotiating table, the 75 countries that called USA to negotiate on the tariffs will now receive a 90 day reprieve from the announced tariff and will only be tariffed at 10% – the minimum import tariff set for all countries on Trump’s “Liberation Day”.

April 10, 2025: China reach out to other countries/blocs in attempt to form a united front against USA. These includes, Australia, European Union, ASEAN and India. Australia and India had turned down China's call for cooperation.

EU and ASEAN spoke, but no agreements had been announced yet.

USA clarified that the effective tariff on China is actually 145%: 125% tariff + 20% tariff in regards to the fentanyl crisis.

April 11, 2025: China raise tariff on US goods from 84% to 125% from April 12, 2025.

Chinese President Xi Jinping met with Spanish Prime Minister Pedro Sanchez in Beijing, and announced state visit to Vietnam from April 14 to 15, and then Malaysia and Cambodia from April 15 to 18.

China's General Administration of Customs has changed its rules of how the origin of imported chips must be classified, now deeming that the wafer fabrication location should be counted as the origin of chips shipped to the country.

April 14, 2025: Confirmation that China is no longer exporting seven heavy rare earth metals processed exclusively in the Asian power, as well as heavy rare earth magnets — of which about 90% of the world’s supply are also synthesized on Beijing’s territory, in the April 3-4 export restriction announcement.

The export halt applies to all countries, but access to elements like dysprosium and yttrium are critical to US industry — especially in the tech, electric vehicle, aircraft and defense sectors (source)

China President Xi Jinping visit Vietnam: Over 40 cooperation agreements were signed, focusing on trade, supply chains, and infrastructure, though specific financial commitments were not disclosed.

April 15, 2025: Nvidia said it was informed by the U.S. government that it will need a license to export its H20 AI chips to China. This license will be required indefinitely, according to the filing — the U.S. government cited “risk that the [H20] may be used in […] a supercomputer in China.”

Chinese government has told the country's domestic airlines to stop accepting deliveries of Boeing jets and also instructing its carriers to stop buying airline parts and other components from U.S. companies.

April 16, 2025: Hong Kong Post say it had suspended goods mail services by sea to the United States and will suspend its air mail postal service for items containing goods from April 27 due to "bullying" U.S. tariffs.

U.S. announce tariff up to 245%, but media reported "increase tariffs to 245%" on Chinese goods - Clarification from the white house: "This includes a 125% reciprocal tariff, a 20% tariff to address the fentanyl crisis, and Section 301 tariffs on specific goods, between 7.5% and 100%."

April 17, 2025: China's government appointed a new trade negotiator, Li Chenggang to replace Wang Shouwen, who participated in negotiations for the countries' 2020 trade deal.

The U.S. Trade Representative (USTR) introduced a new maritime fee structure in April 2025 to counter China's dominance in the maritime, logistics, and shipbuilding sectors while promoting U.S. shipbuilding. The initiative stems from a Section 301 investigation.

April 23, 2025: USA's Department of Commerce concludes trade probe over solar panel related imports, plans to impose tariffs of up to 3,521% on solar panels import from Cambodia, Vietnam, Thailand and Malaysia. Tariffs are largely targeting Chinese companies and transshipments.

April 24, 2025: China quietly exempted eight tariff codes for U.S.-made semiconductors and integrated circuits, as well as certain U.S.-made pharmaceuticals from 125% tariffs, with specific drugs or categories not publicly detailed, from 125% retaliatory tariffs, reducing the rate to 0%.

April 25, 2025: China directed businesses to identify additional “critical goods” for potential future tariff exemptions, with a Ministry of Commerce taskforce collecting lists from companies. Held a Ministry of Commerce roundtable with over 80 foreign firms and chambers to discuss U.S. tariff impacts and gather input on essential imports needing levy-free status.

Censored a Caijing magazine report detailing semiconductor exemptions, removing it three hours after publication to maintain secrecy.

May 2, 2025: China quietly exempts approximately $40 billion worth of U.S. imports from its retaliatory tariffs (125% on U.S. goods), covering about one-quarter of U.S. imports. The exempted goods include pharmaceuticals, microchips, and jet engines, aimed at softening the trade war’s impact on China’s economy.

May 10, 2025: Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer will meet in Geneva with a Chinese delegation led by Vice Premier He Lifeng.

May 12, 2025: USA-China reduce reciprocal/retaliation tariffs to 10% as well as any retaliatory actions by China for 90 Days. This however does not include industry specific tariffs by USA as well as the 20% tariff relating to Fentanyl crisis. De Minimis duty drops from 120% to 54%, but $100 per-postal-item duty remains remains without $150 increase.

KEYSTONE DEVELOPMENT

The U.S. Trade Representative (USTR) introduced a new maritime fee structure in April 2025 to counter China's dominance in the maritime, logistics, and shipbuilding sectors while promoting U.S. shipbuilding.

The initiative stems from a Section 301 investigation, prompted by five U.S. labor unions in March 2024, which concluded that China’s state subsidies and policies unfairly bolster its maritime industry, capturing over 50% of global shipbuilding by 2023.

-

Counter Chinese Dominance: Address China’s market share growth from 5% in 1999 to over 50% in 2023, driven by subsidies and state-backed enterprises, which the USTR deems harmful to U.S. commerce.

-

Revive U.S. Shipbuilding: Stimulate domestic shipyard activity, which has dwindled to producing about five vessels annually compared to China’s 1,700.

-

Economic and Security Benefits: Strengthen U.S. maritime infrastructure, create jobs, and enhance national security by reducing reliance on foreign shipbuilding.

Read more: Full Fee Structure and information

KEYSTONE DEVELOPMENT

Postal packages from China valued at under $800 will then be taxed at 90% of their value or $75 per item, which is scheduled to increase to $150 per item after June 1.

Point of view

"China firmly opposes any party reaching a deal at the expense of China’s interests. If such a situation arises, China will not accept it and will resolutely take reciprocal countermeasures."

People's Republic of China

... commenting on recent media reports about the Trump administration’s plans to pressure countries into restricting trade with China in exchange for exemptions from US tariffs.

Adding, "Appeasement does not bring peace, and compromise does not earn respect.”

“Seeking temporary self-interest at the expense of others — in exchange for so-called exemptions — is like asking a tiger for its skin. In the end, it will achieve nothing and harm both others and oneself.”

China vs World (minus USA) since 2020

January 1, 2020: India introduced tariffs of 15–30% on Chinese electronics, toys, and chemicals under the “Make in India” initiative

May 18, 2020: China imposed 73.6% anti-dumping duty and 6.9% anti-subsidy duty, totaling 80.5% on Australian barley for five years.

October 12, 2020: China suspended imports of Australian cotton and restricted other goods (e.g., timber, lobster) through non-tariff barriers like customs delays and inspections, impacting AUD 300–400 million in exports.

November 28, 2020: China imposed on Australian wine anti-dumping tariffs of provisional duties of 107–212% (averaging 169%).

December 16, 2020: China effectively banned Australian coal imports. No formal tariff was announced, but China imposed an informal ban through verbal directives to state-owned enterprises, halting imports of Australian thermal and coking coal.

March 26, 2021: China finalised Australian wine anti-dumping tariffs of duties of 116–218% duties for five years. (Crushed Australia’s AUD 1.1 billion wine export market to China (40% of total wine exports), dropping to near zero by 2021.)

April 1, 2022: European Union extended anti-dumping duties of 21–42% on Chinese aluminum products, originally imposed on October 15, 2010, through 2024.

January 1, 2023: Canada extended anti-dumping duties of 20–40% on Chinese carbon steel fasteners, originally imposed on September 2, 2005, through 2024.

March 1, 2022: South Africa extended anti-dumping duties of 15–25% on Chinese glass products, originally imposed on April 20, 2018, through 2024.

May 1, 2022: Mexico applied anti-dumping duties of 25–35% on Chinese textiles and apparel, following complaints about market flooding.

June 1, 2022:Australia Applied anti-dumping duties of 10–20% on Chinese solar panel components, extended from measures first imposed on August 22, 2017.

July 1, 2022: Chile extended anti-dumping duties of 10–20% on Chinese steel grinding balls, originally imposed on June 10, 2018.

February 1, 2023: Colombia extended anti-dumping duties of 20% on Chinese ceramic tiles, originally imposed on March 15, 2020, through 2024.

February 14, 2023: China began allowing Australian coal imports informally in January 2023, with significant volumes resuming by February 14, 2023, after diplomatic engagements. No formal tariff was lifted, as the ban relied on non-tariff measures.

March 1, 2023: European Union Applied anti-subsidy duties of 10–20% on Chinese solar panels and components, extended from duties first imposed on December 5, 2013.

Brazil extended anti-dumping duties of 14–20% on Chinese footwear and textiles, originally imposed on April 15, 2019, through 2024.

April 1, 2023: Indonesia applied tariffs of 10–20% on Chinese textiles and garments, extended from measures first imposed on July 1, 2020.

June 1, 2023: China imposed stricter sanitary inspections on Brazilian beef and soybean exports, indirectly retaliating against Brazil’s footwear and textile tariffs.

July 1, 2023: Vietnam applied temporary anti-dumping duties of 15–20% on Chinese aluminum extrusions, following complaints about market distortions.

China extended export controls on dual-use technologies (e.g., semiconductors, aerospace components) to EU firms, citing national security, partly in response to EU aluminum and solar panel tariffs.

July 15, 2023: China imposed anti-dumping duties of 10–15% on Indian chemical exports, such as certain polymers and petrochemicals, in response to India’s broader tariffs on Chinese goods, including electronics and chemicals.

August 1, 2023:Turkey extended tariffs of 15–25% on Chinese machinery and electronics, originally imposed on September 10, 2019, through 2024.

China imposed export license requirements for gallium and germanium, critical for semiconductors and electronics, impacted the EU, which relied on China for 71% of gallium and 45% of germanium imports in 2023. These measures strained EU high-tech industries (e.g., solar products, fiber optics).

August 5, 2023: China lifted the 80.5% tariffs on Australian barley, effective immediately, restoring market access for AUD 1.2 billion in exports. This followed improved bilateral talks and Australia’s decision to pause WTO disputes.

December 1, 2023: China implemented stricter controls on high-purity graphite, used in EV batteries and renewable energy storage, effective December 1, 2023, following an announcement in October 2023. These controls required export licenses and impacted EU industries, as China supplied 65.6% of EU graphite imports in 2024.

March 29, 2024:China fully lifted the 116–218% tariffs on Australian wine, effective March 29, 2024, following the October 2023 review, restoring AUD 1.1 billion in exports

May 5, 2024: Chile imposed tariffs of 15% on Chinese steel bars and rods to protect domestic industry.

June 1, 2024: China increased inspections on Chilean copper exports, a critical sector, as an indirect response to Chile’s steel tariffs. No direct tariffs were imposed.

June 10, 2024: Colombia imposed tariffs of 10–15% on Chinese steel wire and cables to counter subsidized exports.

June 15, 2024: European Union extended anti-dumping duties of 19–36% on Chinese steel products (hot-rolled and cold-rolled steel), originally imposed on February 10, 2017, through 2024.

July 1, 2024: Australia imposed anti-dumping duties of 15–25% on Chinese wind towers and steel reinforcing bars to address unfair trade practices.

July 20, 2024: Turkey imposed anti-dumping duties of 20–30% on Chinese solar panels and modules to protect domestic renewable energy industries.

August 10, 2024: China launched an anti-subsidy investigation into EU dairy products (e.g., cheese, milk), threatening tariffs of up to 20%, in retaliation for the EU’s steel and solar panel duties. No tariffs were imposed by the end of 2024.

August 12, 2024: India imposed anti-dumping duties of up to 20% on certain Chinese steel products, including flat-rolled steel, to protect domestic producers from cheap imports.

August 15, 2024: China launched an anti-dumping investigation into Turkish textile exports, threatening duties of up to 20%, in response to Turkey’s solar panel tariffs. No tariffs were imposed by the end of 2024.

August 20, 2024: Mexico Imposed tariffs of 15–20% on Chinese steel products, including seamless steel pipes, to protect local industry.

September 10, 2024: Brazil imposed tariffs of 12–18% on Chinese steel products, including steel plates and wire rods, to counter low-cost imports.

September 15, 2024: China imposed stricter customs regulations on Mexican auto parts exports, indirectly responding to Mexico’s steel tariffs. No direct tariffs were documented.

China introduced export controls on antimony, a critical mineral used in flame retardants, batteries, and military applications (e.g., night vision devices). Announced on August 15, 2024, and effective September 15, 2024, these restrictions required export licenses, impacting EU supply chains.

October 1, 2024: Canada imposed a 100% surtax on Chinese electric vehicles to counter subsidized imports, aligning with U.S. measures.

China implemented comprehensive regulations on rare earth resources, requiring export licenses for rare earth products (including lanthanum, cerium, praseodymium, neodymium, samarium, gadolinium, terbium, dysprosium, etc.) and established a traceability system for mining, refining, and export activities

Russia on October 1st, 2024, raised significant recycling/utilization fee hike on Chinese vehicles. These fees, a one-time charge for future vehicle disposal, were raised by 70-85% depending on engine size, and from January 2025, fees for Chinese carmakers add over $7,000 for vehicles with 1-2L engines and nearly $20,000 for larger vehicles, on top of a 15% import tariff. Fees are set to rise by 10-20% annually until 2030.

October 5, 2024: Indonesia imposed anti-dumping duties of 15–25% on Chinese cold-rolled stainless steel to protect local manufacturers.

October 15, 2024: Canada imposed a 25% surtax on Chinese steel and aluminum products to protect domestic industries.

China launched an anti-dumping investigation into Brazilian poultry exports, threatening duties of up to 15%, in response to Brazil’s steel tariffs. No tariffs were imposed by the end of 2024.

Russia issued the Directive No. 1374, which expanded the list of banned transit goods banned from transit through Russia (primarily from China), focusing on dual-use items—products like electronics, machinery, and certain textiles (e.g., camouflage clothing) that could have military applications.

October 19, 2024: China Premier Li Qiang has signed a decree of the State Council to unveil regulations on export control of so-called dual use items, which will take effect on Dec. 1, 2024.

October 20, 2024: China launched an anti-subsidy probe into Canadian lumber exports, threatening tariffs of up to 15%, as a countermeasure to Canada’s steel and aluminum surtaxes.

October 30, 2024: European Union Imposed provisional anti-dumping duties of 17–38.1% on Chinese electric vehicles (EVs) following subsidy investigations, set to be finalized in 2025 if negotiations failed.

November 1, 2024: South Africa imposed tariffs of 10–20% on Chinese steel products, including structural steel, to counter subsidized imports.

China imposed anti-dumping duties of 10–20% on Canadian canola oil exports in response to Canada’s EV and steel tariffs. This followed a September 3, 2024, investigation announcement.

November 8, 2024: China imposed anti-dumping duties of 15–30% on EU brandy exports (e.g., French cognac), targeting a politically sensitive sector in France, in direct response to the EU’s EV tariffs.

November 10, 2024: China imposed stricter customs procedures on Indonesian palm oil exports, indirectly responding to Indonesia’s steel tariffs. No direct tariffs were documented.

November 15, 2024: Vietnam imposed anti-dumping duties of 10–25% on Chinese welded steel pipes and tubes to safeguard domestic manufacturers.

December 1, 2024: China imposed stricter customs inspections and non-tariff barriers on Vietnamese agricultural exports (e.g., seafood, rice), indirectly responding to Vietnam’s steel and aluminum tariffs. No direct tariffs were documented.

December 5, 2024: China imposed stricter customs inspections on South African mineral exports (e.g., iron ore), indirectly responding to steel tariffs. No direct tariffs were documented.

2025:

January 1st, 2025: Russia also imposed import tariff of 20-38% on automobiles, which would impact Chinese vehicle makers most directly as China vehicles had dominated Russian market since the withdrawal of European car makers, to protect Russian domestic brands like Avtovaz.

March 7, 2025: Vietnam impose temporary anti-dumping duties of up to 27.83% on certain Chinese steel products to protect domestic industry.

April 1, 2025:India impose 12% temporary tariff on steel imports to counter cheap Chinese steel. Protects domestic producers from China’s subsidized exports.

European Union reduced steel import quotas by 15% to limit inflows of Chinese steel, protecting EU steelmakers from subsidized imports; imposed anti-subsidy duties on top of existing anti-dumping duties on Chinese mobile access equipment, addressing unfair subsidies (e.g., cheap land, tax breaks).

Vietnam strengthened controls on Chinese goods transshipped through Vietnam to avoid U.S. tariffs, increasing costs for Chinese exporters

April 15, 2025: Vietnam’s trade ministry has issued a directive to crack down on illegal transshipment of goods to the United States and other trading partners. Supervision and inspection to be strengthened on imported goods to establish their origin, “especially imported raw materials used for production and export”. New stricter procedures are to be implemented to inspect factories and supervise the release of “Made in Vietnam” labels, “especially for enterprises with a sudden increase in the number of applications for certificates of origin,

April 20, 2025: Brazil introduced a 15% tariff on Chinese textiles and apparel to protect its domestic manufacturers from low-cost imports.

April 25, 2025: Australia applies preliminary anti-dumping duties of up to 20% on Chinese solar panels to address unfair pricing practices and protect the renewable energy sector.

May 5, 2025: Malaysia acknowledged reports of it being used as a transshipment hub for Chinese goods, initiated preliminary investigations to address transshipment practises.

Rest of the World

April 9, 2025: India terminated the transshipment facility that allowed export cargo from Bangladesh to third countries using Indian land customs stations en route to ports and airports. The facility had enabled smooth trade flows for Bangladesh's exports to countries like Bhutan, Nepal, and Myanmar. It was provided by India to Bangladesh in June 2020.

The decision comes against the backdrop of the recent comments made by Bangladesh Chief Adviser Muhammad Yunus on India's northeastern states.

Yunus while addressing a programme apparently in China, has purportedly stated that India has seven landlocked states in its eastern part known as seven sisters and "they have no way to reach the ocean. We are the guardian of the ocean (Bay of Bengal)". He also invited China to send goods through it across the world.

KEYSTONE DEVELOPMENT (28 April 2025)

The European Commission said it had imposed duties of up to 66.7% on imports of Chinese machines that lift construction workers after concluding that the producers were benefiting from unfair subsidies and selling at artificially low prices.

The extra duties on Chinese mobile access equipment (MAE) will range from 20.6% to 66.7%, the Commission said, as it sought to protect domestic producers in the EU market worth more than 1 billion euros ($1.14 billion) per year.

The EU executive, which conducted the investigation, said Chinese MAE producers had benefited from preferential financing, grants, state provision of inputs at below-market rates.

The Commission said Chinese producers had gained a 41% market share in the year from October 2022, from 29% in 2020, and sold at prices some 20% below EU competitors.

The tariffs will apply to Chinese companies such as Hunan Sinoboom Intelligent Equipment Co, Zoomlion Intelligent Access Machinery and Zhejiang Dingli Machinery Co. EU MAE producers include French companies Haulotte and Manitou.

The European Union now has in place anti-dumping or anti-subsidy duties on almost 80 Chinese products from truck tyres to ironing boards.

European Union vs China

January 7, 2025: EU trade commissioner Maroš Šefčovič announces enhanced import monitoring for Chinese steel and electronics, citing risks of trade diversion from U.S. tariffs (104% on Chinese goods).

February 3, 2025: China’s commerce ministry extends anti-dumping probes into EU dairy, adding pressure on Ireland and the Netherlands, in response to EU EV tariffs (25-35%).

February 14, 2025: European Central Bank releases a report estimating a potential 0.14-0.2% EU GDP drop if U.S.-China trade war escalates, urging stronger trade defenses against Chinese overcapacity.

March 10, 2025: China imposes preliminary 15% tariffs on EU wine imports, escalating retaliation for EU EV tariffs.

March 27, 2025: China’s Vice Premier He Lifeng meets EU trade chief Maroš Šefčovič in Beijing, proposing joint resistance to U.S. protectionism and offering EV tariff concessions; EU remains cautious, prioritizing market fairness.

April 2, 2025: EU Commission launches a review of Chinese battery imports, suspecting state subsidies, amid fears of U.S. tariff-driven trade diversion.

April 10, 2025: China’s commerce ministry confirms 84% tariffs on U.S. goods (up from 34%), prompting EU concerns about redirected Chinese exports flooding European markets.

April 11, 2025: European Commission President Ursula von der Leyen speaks with Chinese Premier Li Qiang via phone, pressing China to prevent trade diversion from U.S. tariffs (now 125% on Chinese goods) and address overcapacity issues.

April 12, 2025: China announces 125% tariffs on U.S. goods, effective immediately, further heightening EU fears of Chinese goods flooding Europe.

EU and China agree to restart negotiations on EV minimum price schemes as a potential alternative to EU tariffs, with no set deadline for conclusion.

April 29, 2025: The EU imposes 66.7% anti-dumping duties on Chinese construction machinery, following a determination that Chinese producers were benefiting from unfair subsidies and selling at artificially low prices.

April 30, 2025: China lifted sanctions it imposed on five European Union lawmakers in retaliation against the bloc’s defense of Uyghur Muslims in the far western Xinjiang region.

EU vs china (historical)

2018-2020: Early Tensions

2018: EU launches Foreign Direct Investment screening to scrutinize Chinese investments in strategic sectors.

2019: EU labels China a “systemic rival,” signaling tougher stance on trade imbalances and market distortions.

2020: EU-China Comprehensive Agreement on Investment (CAI) negotiations conclude, but ratification stalls due to human rights concerns and lack of reciprocity.

2021-2022: Escalating Frictions

2021: EU imposes sanctions on Chinese officials over Xinjiang; China retaliates with sanctions on EU lawmakers, freezing CAI progress.

2022: EU trade deficit with China peaks at €396 billion. EU introduces Foreign Subsidies Regulation to counter Chinese state-backed firms.

Late 2022: Concerns grow over Chinese overcapacity in solar panels and batteries, prompting EU investigations.

2023: Focus on Electric Vehicles (EVs)

Mid-2023: EU launches anti-subsidy probe into Chinese EVs, citing unfair state support.

October 2023: EU proposes tariffs on Chinese EVs, ranging from 7.8% to 35%, sparking Chinese backlash.

November 2023: China initiates anti-dumping probes into EU brandy and pork, targeting France and Spain to exploit EU divisions.

2024: Tit-for-Tat Measures

Early 2024: EU tariffs on Chinese EVs take effect, averaging 25-35%. China expands probes to EU wine and dairy.

June 2024: EU and China hold High-Level Economic and Trade Dialogue, agreeing to explore alternatives to tariffs but making little progress.

September 2024: China proposes minimum price schemes for EVs to avoid tariffs, modeled on past solar panel deals, but EU remains skeptical.

October 2024: EU strengthens anti-coercion measures to counter Chinese retaliatory tariffs, signaling readiness to escalate if needed.

USA vs Canada

February 1, 2025: The trade war officially begins when President Trump signs executive orders imposing 25% tariffs on all Canadian goods entering the U.S., except for oil and energy products, which face a 10% tariff. This follows his inauguration and fulfills campaign promises to address perceived trade imbalances and border security issues.

Canadian Prime Minister Justin Trudeau responds, announcing Canada will retaliate with 25% tariffs on CA$30 billion (US$20.6 billion) of U.S. goods with plans to expand to CA$155 billion (US$106 billion) in three weeks unless the U.S. reverses course.

Trump escalates rhetoric, suggesting Canada should become the "51st state" to eliminate tariffs, claiming economic benefits and security for Canada, a proposal Trudeau denounces as a threat to Canadian sovereignty.

February 3, 2025: One day before tariffs are set to take effect, Trudeau and Mexican President Claudia Sheinbaum negotiate a one-month delay with the U.S., pushing the implementation to March 4, 2025. Canada pauses its retaliatory tariffs in response, hoping for further talks.

March 4, 2025: After failed negotiations and Trump’s insistence that Canada hasn’t addressed fentanyl trafficking or trade deficits sufficiently, U.S. tariffs go into effect at midnight. Canada’s 25% tariffs on US$20.6 billion of American goods (Phase 1) also activate, targeting items like liquor, vegetables, clothing, and shoes. Trudeau confirms a second wave (CA$125 billion, or US$86 billion) will follow on March 25 unless the U.S. relents.

Financial markets react with volatility, and economists warn of inflation and supply chain disruptions across North America.

March 12, 2025: Tensions spike as Trump doubles steel and aluminum tariffs on Canada to 50%, citing national security. Ontario Premier Doug Ford threatens a 25% surcharge on electricity exports to three U.S. states (affecting over 1 million homes), but backs off after Trump threatens further escalation. The White House then reverts to the original 25% metals tariffs, calling it a “win” for U.S. leverage.

Stock markets drop further amid uncertainty.

March 13, 2025: Canada initiates a WTO dispute over US steel and aluminum duties, signaling a legal counter-strategy alongside tariffs.

March 27, 2025: US announces a 25% tariff on all car imports, effective April 3, hitting Canada’s auto sector (e.g., Ontario exports).

April 2, 2025: Trump declares a national emergency, imposing a 10% universal tariff on all US imports (effective April 5) and reciprocal tariffs on Canada: 0% for USMCA-compliant goods, 25% for non-compliant (potentially reducible to 12% if Canada meets immigration/drug demands, effective April 9).

April 3, 2025: New Canadian Prime Minister Mark Carney (having succeeded Trudeau in March 2025) announces a 25% tariff on U.S. vehicles not compliant with USMCA rules, signaling Canada’s intent to protect its auto industry amid ongoing tensions.

April 5, 2025: US 10% universal tariff takes effect, adding to Canada’s existing 25% burden on non-exempt goods.

April 7, 2025: Canada files a second WTO dispute over US car tariffs, escalating legal efforts while adjusting supply chains as a non-tariff response.

April 9, 2025: US reciprocal tariffs (0% USMCA-compliant, 25% non-compliant) take effect. Canada retaliates with 25% tariffs on non-USMCA-compliant US-made vehicles and related content, intensifying the auto sector conflict.

Point of view

"It’s time to make Canada the world’s leading energy superpower — to reduce our reliance on other countries, fight for Canadian jobs, and defend our economic sovereignty."

Canada

... in a post on X.

USA vs Mexico

February 1, 2025: The trade war kicks off when U.S. President Donald Trump signs executive orders imposing 25% tariffs to take effect February 4 on all Mexican goods entering the U.S., citing trade deficits, illegal immigration, and fentanyl trafficking as justifications. Mexican President Claudia Sheinbaum vows retaliatory tariffs and non-tariff measures but doesn’t specify targets initially.

February 3, 2025: After negotiations with Trump, Sheinbaum secures a one-month delay, pushing the U.S. tariffs’ implementation to March 4, 2025. Mexico pauses its planned retaliation in hopes of further dialogue.

March 4, 2025: U.S. tariffs on Mexican goods take effect at 25%, except for USMCA-compliant goods, which are temporarily exempted until April 2. Sheinbaum emphasizes avoiding a full confrontation and proposes a U.S.-Mexico task force to address Trump’s concerns.

March 6, 2025: Trump grants temporary exemptions for all USMCA-compliant goods until April 2, softening the immediate blow to Mexico’s auto industry. Mexico holds off on detailing its full counter-tariffs, signaling a wait-and-see approach.

April 2, 2025: Trump announces a 10% global tariff (“Liberation Day”), spares Mexico/Canada extra tariffs beyond 25% on non-USMCA goods, and makes USMCA-compliant goods tariff-free indefinitely. U.S. imposes 25% tariffs on Mexican automobiles and parts. Sheinbaum celebrates this as a win, suggesting it preserves much of Mexico’s U.S. market access.

April 3, 2025: Mexico to unveil "Plan México" for domestic production boosts in food and energy, avoiding immediate tariffs.

USA vs European Union

February 2, 2025: Trump tells reporters he plans to impose tariffs on the EU “pretty soon” to address the $235.6 billion U.S. goods trade deficit with the bloc in 2024, accusing the EU of not taking enough American cars, farm products, and energy.

February 4, 2025: EU trade ministers convene in Warsaw to discuss Trump’s tariff threats. The bloc signals readiness to negotiate but warns of retaliation if talks fail. Polish PM Donald Tusk calls a tariff war “totally unnecessary and stupid.”

February 7, 2025: The EU proposes lowering its 10% car import tariff to align closer to the U.S.’s 2.5% rate and increasing purchases of U.S. liquefied natural gas (LNG) and military equipment to avert a trade war.

February 25, 2025: French President Emmanuel Macron meets Trump at the White House, urging him to focus tariffs on China rather than Europe. No immediate agreement is reached, but talks continue.

March 12, 2025: Trump’s 25% tariffs on all steel and aluminum imports, including from the EU, go into effect. The EU announces a two-phase retaliatory plan targeting $28 billion in U.S. goods (initially set for April 1, later delayed).

March 20, 2025: The European Commission delays its initial countermeasures (originally €4.5 billion in tariffs on U.S. goods like whiskey and motorcycles) from April 1 to mid-April, allowing more time for negotiations and consultation with member states.

March 26, 2025: The U.S. imposes a 25% tariff on all car imports, hitting the EU hard, particularly Germany, the world’s largest car exporter.

April 2, 2025: Trump declares a national emergency, imposing a 10% universal tariff on all U.S. imports (effective April 5) and a 20% reciprocal tariff on EU goods (effective April 9). The EU calls it a “catastrophe” and accelerates retaliation plans.

Commission President Ursula von der Leyen appeals for talks but finalizes a €26 billion counter-tariff package, including €4.5 billion from prior measures and a broader second tranche.

April 5, 2025: The U.S. universal tariff takes effect, impacting all EU exports to the U.S., such as pharmaceuticals, machinery, and vehicles. EU exports worth $532 billion in 2024 are now at risk.

April 7, 2025: EU trade ministers in Luxembourg offer a “zero-for-zero” tariff deal on industrial goods (cars, machinery, pharmaceuticals), echoing past Transatlantic Trade and Investment Partnership (TTIP) talks.

The European Commission proposes 25% tariffs on select U.S. goods (e.g., dental floss, diamonds), scaled back from initial plans after pressure to exclude bourbon and dairy, with implementation set for April 15.

April 8, 2025: Trump has rejected Europe’s offer of a zero-for-zero tax deal - but Trump says he’ll lift tariffs… if EU buy €350 billion in energy from him. Nice blackmail!

April 9, 2025: The U.S. 20% tariff on EU goods takes effect today, covering 70% of EU exports to the U.S. EU Trade Commissioner Maros Sefcovic meets U.S. counterparts, describing talks as “frank” but fruitless so far.

April 10, 2025: EU-specific tariffs, previously set at 20% for most goods (with 25% on steel, aluminum, and cars), are temporarily lowered to 10% during this pause, pending further talks.

The EU confirmed a 90-day pause on its countermeasures to align with the U.S. pause, aiming for negotiations.

ARCHIVES

USA vs china (Trump's first term / historical)

March 2017: U.S. President Donald Trump signs an executive order to tighten tariff enforcement in anti-dumping and anti-subsidy cases, signaling a tougher stance on trade, including with China.

April 2017: Trump and Chinese President Xi Jinping agree to a 100-day plan for trade talks aimed at reducing the U.S. trade deficit with China. The talks fail to produce an agreement by July.

August 14, 2017: Trump orders a "Section 301" investigation into alleged Chinese intellectual property theft, which the U.S. estimates costs it up to $600 billion annually.

January 22, 2018: Trump imposes tariffs on imported solar panels (30%) and washing machines, affecting China and other countries, marking an early escalation in trade tensions.

March 23, 2018: The U.S. imposes 25% tariffs on steel and 10% on aluminum imports from all trading partners, including China, under Section 232 of the Trade Expansion Act of 1962, citing national security concerns.

April 2, 2018: China retaliates by suspending tariff reductions and imposing tariffs on 128 U.S. products worth $3 billion, including a 25% tariff on pork and 15% on fruits and nuts.

April 3, 2018: The U.S. announces 25% tariffs on 1,333 Chinese products worth $50 billion, targeting technology and industrial goods, under Section 301 findings of unfair trade practices.

April 4, 2018: China responds with 25% tariffs on 106 U.S. products worth $50 billion, including soybeans, automobiles, and aircraft.

July 6, 2018: The U.S. implements 25% tariffs on $34 billion of Chinese imports (first stage of the $50 billion list). China retaliates with 25% tariffs on $34 billion of U.S. goods, including agricultural products.

August 23, 2018: The U.S. imposes 25% tariffs on an additional $16 billion of Chinese goods (second stage of the $50 billion list). China mirrors this with 25% tariffs on $16 billion of U.S. goods.

September 24, 2018: The U.S. imposes 10% tariffs on $200 billion of Chinese imports, set to rise to 25% on January 1, 2019. China retaliates with 5-10% tariffs on $60 billion of U.S. goods.

December 1, 2018: Trump and Xi agree to a 90-day truce, halting new tariffs to allow for negotiations. China commits to buying a "very substantial" amount of U.S. exports.

May 10, 2019: After talks break down, the U.S. increases tariffs on $200 billion of Chinese goods from 10% to 25%. China announces tariffs on $60 billion of U.S. goods effective June 1.

August 23, 2019: Trump calls for U.S. companies to seek alternatives to China and announces additional tariff hikes. The Dow drops 623 points amid escalating tensions.

September 1, 2019: The U.S. imposes an additional 15% tariff on $31 billion of Chinese textile and apparel products. China retaliates with further tariffs on U.S. goods.

December 13, 2019: The U.S. and China reach a "Phase One" trade deal, suspending a planned 15% tariff increase on $4.7 billion of Chinese goods set for December 15.

January 15, 2020: Trump and Chinese Vice Premier Liu He sign the Phase One trade deal in Washington, D.C. China agrees to purchase an additional $200 billion in U.S. goods and services over 2020-2021, above 2017 levels. The U.S. reduces tariffs on $120 billion of Chinese goods from 15% to 7.5%.

February 14, 2020: Tariffs on $31 billion of Chinese textile and apparel products drop from 15% to 7.5% as part of the Phase One implementation.

2020-2021: China falls short of its Phase One purchase commitments, reaching only about 58% ($99 billion) of the $173.1 billion target for 2020, amid the COVID-19 pandemic and economic disruptions.

January 20, 2021: Trump’s first term ends. The trade war is widely seen as failing to resolve core U.S. concerns, though the U.S.-China trade deficit shrinks from $375 billion (2017) to $310.8 billion (2020). The broader U.S. trade deficit worsens.

2021-2024: Under President Joe Biden, most Trump-era tariffs on China remain in place, with a more targeted approach to trade policy. Tensions persist but tariff escalations stabilize.

KEYSTONE DEVELOPMENT

U.S. Customs and Border Protection released a bulletin late on 11 April 2025 EDT that a series of product categories will be excluded from the 2 April 2025 reciprocal tariff list. (full list)

KEYSTONE DEVELOPMENT (2 May 2025)

A list of exempted US products covering 131 items such as pharmaceuticals and industrial chemicals has been circulating among traders and businesses over the past week.

The 131 items are worth about US$40 billion, or around 24 per cent of Chinese imports from the US in 2024 Bloomberg calculations based on China Customs data show.

DEVELOPMENT (9 May 2025)

Deputy Prime Minister Ho Duc Phoc is on a working trip to the U.S. for tariff-related negotiations, and is expected to meet with Treasury Secretary Scott Bessent. Phoc is scheduled to meet Bessent on April 10

Reuters reported that he is also expected to meet with executives from major U.S. companies, including Boeing, SpaceX and Apple, and attend a ceremony where Vietnamese budget carrier Vietjet and investment fund KKR will sign a contract for a $200-million financing deal for buying aircraft.

U.S. Trade Representative Jamieson Greer told the Senate Finance Committee on Tuesday that Vietnam had lowered tariffs on American cherries, apples and almonds, all important exports for the country’s western states.

DEVELOPMENT

Nvidia Corp. Chief Executive Officer Jensen Huang arrived in Beijing Thursday, shortly after the Trump administration barred the company from selling H20 AI chip to China.

Huang met with Ren Hongbin, chairman of the China Council for the Promotion of International Trade, and said China is a "very important market" for Nvidia and that "we hope to continue to cooperate with China," state-run CCTV reported.

Huang met with Chinese Vice Premier He Lifeng on Thursday evening, state-run Xinhua News Agency reported. He told Huang that China welcomes more US companies including Nvidia to deepen their presence in the Chinese market. Huang expressed optimism about China’s economic outlook and affirmed Nvidia’s commitment to exploring the local market and playing an active role in promoting the US-China economic and trade cooperation.

The CEO also met with DeepSeek founder Liang Wenfeng, the Financial Times reported, citing unidentified sources. An Nvidia representative declined to comment.

Point of view

"Intimidation does not scare us. Bullying does not work on us. Pressuring, coercion or threats are not the right way of dealing with China. Anyone using maximum pressure on China is picking the wrong guy and miscalculating. If the U.S. truly wants to solve the fentanyl issue, then the right thing to do is to consult with China by treating each other as equals.

If war is what the U.S. wants, be it a tariff war, a trade war, or any other type of war, we’re ready to fight till the end."

China

... in a statement posted on X by @MFA_China reacting to US's 20% tariff on Chinese imports, prompting China’s retaliatory tariffs on U.S. agricultural goods

DEVELOPMENT

Container throughput from China’s main ports fell by 6.1% over the past week and cargo bookings over the next three weeks are projected to be down by 30-60% in China and by 10-20% in the rest of Asia as the trade war intensifies.

Market intelligence group Linerlytica said that recent tariff concessions are likely insufficient to restore transpacific volumes with about 30-40% of transpacific container imports still effectively halted by the tariffs that remain in place.

The trade war is principally affecting carriers with the largest exposure to Chinese transpacific exports to the US, with Hede (100%), Matson (90%), SeaLead (82%), TS Lines (80%) and COSCO (71%) being most at risk from the immediate fallout.

US container imports surged over the first three months of the year as retailers pulled forward volumes to get ahead of the tariffs.

But the Global Port Tracker from the NRF and Hackett Associates is predicting import cargo at the nation’s major container ports to drop dramatically beginning next month.

“Imports during the second half of 2025 are now expected to be down at least 20% year over year,” Hackett Associates Founder Ben Hackett said. “Even balanced against elevated levels earlier this year, that could bring total 2025 cargo volume to a net decline of 15% or more unless the situation changes.”

DEVELOPMENT

China's General Administration of Customs has changed its rules of how the origin of imported chips must be classified, now deeming that the wafer fabrication location should be counted as the origin of chips shipped to the country.

This rule exempts products from AMD, Nvidia, Qualcomm, Intel, and other chipmakers who outsource wafer fabrication to Taiwanese companies from the punitive 125% tariff China now imposes on products from the U.S. However, this badly hurts Intel, Global Foundries, Texas Instruments, and chip designers who produce chips in America

This helps China to bypass their own tariff regime in order to soften the blow to their own economy, similar to USA's action to soften the blow to theirs by removing semicon products to a separate bucket from the reciprocal tariffs.

DEVELOPMENT (10 May 2025)

U.S. President Donald Trump hailed talks with China in Switzerland on Saturday, saying the two sides had negotiated "a total reset ... in a friendly, but constructive, manner."

"A very good meeting today with China, in Switzerland. Many things discussed, much agreed to," Trump posted on his Truth Social platform.Trump added: "We want to see, for the good of both China and the U.S., an opening up of China to American business. GREAT PROGRESS MADE!!!" He did not elaborate on the progress.

KEYSTONE DEVELOPMENT (24 April 2025)

Eight specific tariff codes related to semiconductors and integrated circuits were exempted, reducing tariffs from 125% to 0%. This covered most semiconductors except memory chips

Select U.S.-made pharmaceuticals exempted from 125% tariffs, reducing the rate to 0%

SEMICON: The exact eight HS codes were not publicly disclosed in available sources due to China’s secrecy and the censorship of Caijing’s report on April 25, 2025.

Shenzhen-based import agencies, including Zhengnenliang Supply Chain, confirmed the exemptions during routine customs clearance on April 24, 2025, noting zero tariffs on eight integrated circuit codes.

China’s Ministry of Commerce and Foreign Ministry did not confirm the exemptions, and Caijing’s report was removed within three hours on April 25, 2025, indicating Beijing’s intent to keep the action quiet.

PHARMA: Michael Hart, president of the Beijing-based American Chamber of Commerce, reported on April 25, 2025, that some pharmaceutical companies imported drugs without tariffs over the past week, based on anecdotal member feedback.

A European medical equipment maker in China noted negotiations with Chinese authorities for tariff exemptions, suggesting critical drugs or APIs were prioritized to avoid supply disruptions.

No official confirmation from China’s Ministry of Commerce or customs authorities, with a Foreign Ministry spokesperson claiming ignorance on April 25, 2025.

DEVELOPMENT (8 May 2025)

Vietnam's surplus with the United States - already one of the highest globally - expanded by nearly 25% in the four months to April year on year, according to Vietnam's statistics agency. In March alone, it exceeded $13.5 billion, the highest monthly figure ever, U.S. data showed.

In April, shipments to the U.S. exceeded $12 billion, 34% higher than a year earlier, and the largest value recorded after the COVID-19 pandemic, Vietnam's customs data showed.Vietnam's Cai Mep deep-sea port, which handles most of the country's sea-borne exports to the United States, is experiencing a surge in shipments to the U.S., said Soren Pedersen, vice president at SSA Marine, which operates a port in Cai Mep and is one of the world's largest port operators.

At the same time, Vietnam is ramping up imports from China, which also reached a post-pandemic record in April, exceeding $15 billion, according to customs data.

Vietnam's exports to the U.S. in recent years have been fuelled by imports from China, with inflows from Beijing closely matching the value and swings of exports to Washington.

Point of view

"I’m looking at something to help some of the car companies where they’re switching to parts that were made in Canada, Mexico and other places and they need a little bit more time.

They’re going to make them here, but they need a little bit more time."

United States of America

... remarked during a bilateral meeting with El Salvador’s President Nayib Bukele in the Oval Office.

Point of view

"China and Europe should fulfil their international responsibilities… and jointly resist unilateral bullying practices"

People's Republic of China

... said during his meeting with Spanish Prime Minister Pedro Sanchez, Xi said China and the EU should cooperate more closely to deal with the growing trade tensions between Beijing and Washington.

This, he stressed, would not only “safeguard their own legitimate rights and interests, but also… safeguard international fairness and justice.”

Point of view

"Look, I'm a very flexible person. I don't change my mind, but I'm flexible," Trump said. "And you have to be. You just can't have a wall. Sometimes you have to go around it, under it or above it."

United States of America

... remarked during a bilateral meeting with El Salvador’s President Nayib Bukele in the Oval Office, commenting on being flexible on the tariffs issues.

Point of view

"It's about pursuing Australia's national interests, not about making common calls with China"

Australia

... rebuffing China's offer for a joint resistance as "the only way" to stop the "hegemonic and bullying behaviour of the US", appealing for Canberra's cooperation in an opinion piece on 10 April 2025.

Prime Minister Anthony Albanese, however, said Australians would "speak for ourselves", while the country's defence minister said the nation would not be "holding China's hand".

DEVELOPMENT

The AI chipmaking giant said it has worked with manufacturing partners to commission over 1 million square feet of manufacturing space to build and test Nvidia's advanced Blackwell chips in Arizona as well as AI supercomputers in Texas.

The company said it has already started production of Blackwell chips at TSMC's chip plant in Phoenix.

Nvidia is also building two supercomputer manufacturing plants in Texas – one with Foxconn in Houston and another with Wistron in Dallas. The company said it expects mass production to ramp up at both plants in the next 12 to 15 months. (source)

Point of view (4 May 2025)

"Amid rising uncertainties and long-term structural shifts, we reaffirm our full commitment to multilateralism, and a rules-based, non-discriminatory, free, fair, open, inclusive, equitable, and transparent multilateral trading system, with the World Trade Organization at its core."

ASEAN+3

... noted in the Joint Statement of the 28th ASEAN+3 Finance Ministers’ and Central Bank Governors’ Meeting at Milan, Italy.

The statement also noted the continued implementation of the Regional Comprehensive

Economic Partnership (RCEP) Agreement.

DEVELOPMENT (21-22 April 2025)

Malaysia Airlines is seizing on the opportunity to expand its fleet by targeting Boeing jets that Chinese airlines may reject. | Air India Ltd. is looking to take Boeing Co. planes rejected by Chinese carriers, people familiar with the matter said, joining the ranks of Asian airlines vying to benefit from the trade war between Washington and Beijing.

According to major news sources, Datuk Captain Izham Ismail, MAG’s managing director, confirmed that Malaysia Airlines is in talks with Boeing to secure delivery slots vacated by Chinese carriers.

This could fast-track the airline’s goal of operating 55 next-generation Boeing 737 MAX jets by 2030. These potential acquisitions would notably be separate from MAG’s existing order of 25 737 MAX aircraft.

Air India, the Tata Group-owned carrier, which urgently needs aircraft to expedite its revival, plans to approach Boeing about acquiring a number of jets the US planemaker was readying for Chinese airlines before reciprocal tariffs thwarted the handovers, according to the people, who are familiar with discussions at the Indian airline and didn’t want to be identified because the information isn’t public.

Air India is also eager to take up slots for future deliveries should they become available, the people said.

DEVELOPMENT

The United States and Vietnam agreed to start talks for a trade agreement, the Vietnamese government said on Thursday, hours after the U.S. paused the implementation of global "reciprocal" tariffs, including a 46% levy on Vietnam.

- The two countries will consider removing as many non-tariff barriers as possible, Hanoi said in a statement released after a meeting between Vietnam's Deputy Prime Minister Ho Duc Phoc and U.S. Trade Representative Jamieson Greer in Washington.

- Export-reliant Vietnam is hoping to get the duties reduced to a range of 22% to 28%, if not lower (rumor)

- Vietnam to tighten controls and officials were given two weeks to devise a plan to clamp down on illicit transhipment. The deadline could be extended until late April, while Hanoi wanted to be careful not to provoke China. (rumor)

Illicit transhipment refers to one country sending goods to a nation facing lower tariffs from a third country, to which the product is re-exported without having value added to it.

- Vietnam's government said on its official portal it would crack down on "trade fraud." It did not provide specifics.

- Two Vietnamese airlines announced deals with U.S. financial companies to fund their expansion. (10 April 2025).

VietJet sign 300 million deal with AV AirFinance to facilitate the delivery of planes it needs over the next two years. Purchases of planes would be crucial to reduce Vietnam's large surplus with the United States.

Vietnam Airlines announced a separate non-binding deal with Citibank (C.N), worth more than $560 million aimed at "strengthening the airline's operational capacity and expanding its international route network in the years ahead,"

DEVELOPMENT

Over 40 cooperation agreements were signed on April 14, focusing on trade, supply chains, and infrastructure, though specific financial commitments were not disclosed. (read more)

Supply Chains: Deals to enhance production and supply chain resilience, particularly for electronics and manufacturing, to counter U.S. tariff disruptions.

Railway Cooperation: Agreements to assess new railway projects, with China potentially funding and providing technology for Vietnam’s rail network upgrades.

Trade Certification: A memorandum between the China Council for the Promotion of International Trade and the Vietnam Chamber of Commerce to boost cooperation on certifying goods’ origins, addressing U.S. concerns about Chinese transshipments.

Emerging Sectors: Pacts to expand collaboration in 5G, artificial intelligence, and green energy, aiming to integrate Vietnam into China’s tech ecosystem.

Cultural Ties: Plans for a “Year of Vietnam-China Humanistic Exchange” in 2025 to strengthen people-to-people connections.

Point of view

"I don't blame China, I don't blame Vietnam. I see they're meeting today. Isn't that wonderful? That's a lovely meeting...

...trying to figure out, how do we screw the United States of America?"

United States of America

... remarked during a bilateral meeting with El Salvador’s President Nayib Bukele in the Oval Office, commenting on Xi Jinping's visit to Vietnam.

DEVELOPMENT