USTR Section 301 Action’s New Maritime Fee Structure against China

The U.S. Trade Representative (USTR) introduced a new maritime fee structure in April 2025 to counter China’s dominance in the maritime, logistics, and shipbuilding sectors while promoting U.S. shipbuilding.

The initiative stems from a Section 301 investigation, prompted by five U.S. labor unions in March 2024, which concluded that China’s state subsidies and policies unfairly bolster its maritime industry, capturing over 50% of global shipbuilding by 2023.

The revised fee structure was announced on April 17, 2025, with implementation set for October 2025.

Below is a detailed overview based on available information:

Key Components of the USTR’s Maritime Fee Plan

Fee Structure:

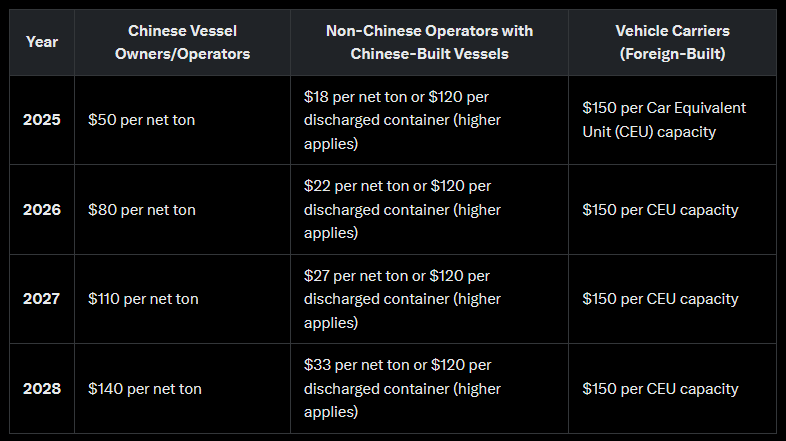

- Chinese Vessel Owners/Operators: Fees are assessed on vessels calling at U.S. ports, starting at $50 per net ton in 2025, increasing annually by $30 to reach $140 per net ton by 2028.

- Non-Chinese Operators with Chinese-Built Vessels: Lower fees apply, starting at $18 per net ton (rising to $33 by 2028) or $120 per discharged container, whichever is higher.

- Vehicle Carriers: A fee of $150 per Car Equivalent Unit (CEU) capacity is imposed on foreign-built vehicle carriers.

- Implementation: Fees begin after a 180-day grace period (effective around October 2025) and are applied at the first U.S. port of entry per voyage, capped at five fees per vessel annually.

- Exemptions: U.S.-owned vessels, those in U.S. Maritime Administration programs, smaller vessels, ships in ballast, short-sea shipping, and certain specialized export vessels are exempt. Great Lakes vessels (U.S. and Canadian) and those serving Caribbean islands or U.S. territories are also excluded.

Below is a table summarizing the USTR’s maritime fee structure for 2025–2028, as outlined in the April 2025 announcement. The fees apply to vessels calling at U.S. ports, with different rates for Chinese vessel owners/operators and non-Chinese operators using Chinese-built vessels. Additional details on vehicle carriers and exemptions are noted where applicable.

Notes:

- Implementation: Fees begin after a 180-day grace period (around October 2025).

- Application: Assessed at the first U.S. port of entry per voyage, capped at five fees per vessel annually.

- Exemptions: U.S.-owned vessels, Maritime Administration program vessels, smaller vessels, ships in ballast, short-sea shipping, Great Lakes vessels (U.S./Canadian), and vessels serving Caribbean islands or U.S. territories are exempt.

- Fee Remission: Operators committing to purchase U.S.-built vessels may receive a temporary fee suspension for up to three years.

For full details, refer to the Federal Register Notice or https://ustr.gov.

Of the 8,775,208 total TEU arrived at U.S. ports in 2024, 1,507,717 TEU (17.18%) were transported by Chinese-built vessels. (source)

Fee Remission Incentive:

- Operators committing to purchase U.S.-built vessels of equivalent or larger size can receive a temporary fee suspension for up to three years, encouraging investment in domestic shipbuilding.

Cargo Preference for LNG Exports:

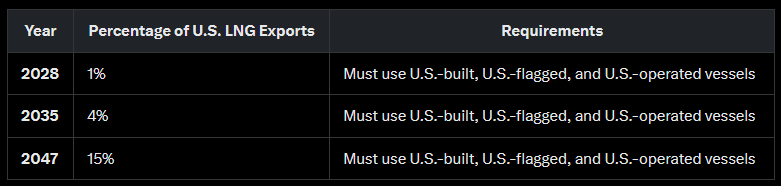

- Starting April 17, 2028, 1% of U.S. liquefied natural gas (LNG) exports must use U.S.-built, flagged, and operated vessels, increasing to 4% by 2035 and 15% by 2047. This reflects the limited U.S. capacity for LNG carrier construction.

Key Details:

- Start Date: The requirement begins on April 17, 2028, with a gradual increase over time.

- Purpose: To incentivize the construction and use of U.S.-built LNG carriers, addressing the current lack of domestic capacity (U.S. shipyards produce fewer than 10 vessels annually, with no significant LNG carrier production).

- Rationale: The USTR aims to counter China’s dominance in global shipbuilding (over 50% market share) and bolster U.S. maritime infrastructure, job creation, and national security.

- Challenges: Industry stakeholders note that U.S. shipyards currently lack the capacity to build LNG carriers at scale, and meeting these targets may require significant investment and time. This could lead to higher costs for LNG exports, potentially impacting competitiveness.

Tariffs on Chinese Cranes:

- The plan includes tariffs of up to 100% on Chinese-manufactured ship-to-shore cranes, addressing China’s control over global crane production and potential U.S. supply chain vulnerabilities.

Objectives

Counter Chinese Dominance: Address China’s market share growth from 5% in 1999 to over 50% in 2023, driven by subsidies and state-backed enterprises, which the USTR deems harmful to U.S. commerce.

Revive U.S. Shipbuilding: Stimulate domestic shipyard activity, which has dwindled to producing about five vessels annually compared to China’s 1,700.

Economic and Security Benefits: Strengthen U.S. maritime infrastructure, create jobs, and enhance national security by reducing reliance on foreign shipbuilding.

Background and Development

- The USTR’s actions follow a petition by unions, including the United Steelworkers, filed on March 12, 2024, leading to an investigation concluding on January 16, 2025.

- Initial proposals in February 2025 suggested fees as high as $1.5 million per port call for Chinese-built vessels and $1 million for Chinese operators or those with Chinese-built ships. These faced significant pushback for their potential to disrupt trade and raise costs.

- After public hearings in March 2025 and over 300 business groups opposing the original plan, the USTR scaled back fees, introduced exemptions, and adopted a tonnage-based structure to mitigate impacts.

Industry and Economic Concerns

Cost Increases: The World Shipping Council (WSC) warns that fees could raise consumer prices, particularly for automobiles due to vehicle carrier fees, and harm U.S. exporters like farmers by increasing shipping costs. For example, a COSCO vessel could face $10.5 million per voyage, potentially doubling container shipping costs.

Trade Disruptions: Critics argue fees may divert cargo to Canadian or Mexican ports, congesting border crossings and reducing U.S. port activity, especially at smaller ports.

Caribbean Impact: The Caribbean, reliant on U.S. exports and Chinese-built vessels, faces severe risks, with potential cost increases threatening food imports and tourism.

U.S. Shipbuilding Capacity: Stakeholders highlight that U.S. shipyards lack the capacity to meet demand, producing fewer than 10 ships annually, and scaling up could take years.

DPA Note: This is a under focused development that will massively damage China’s commercial ship building industry, as the buying of US made ships are highly incentivised while China-linked ships are heavily penalized.

The time horizon of the increasing penalty matches Trump’s 4 year term, but also matches the 2-3 years building time of a large container ship – giving shipping companies time to buy and replace their fleet with new US-build ships.

This would boost US ship-building industry like super-steroids – although it remains to be seen whether USA would be able to build new shipyards fast enough to deal with the expected massively increased order.

The realistic expectations is also reflected by the long time line for US-build LNG ships for LNG exports with just 1% by 2028 – showing the lack of the capacity to build LNG ships right now in USA – the 1% might actually just be 1 vessel, the very first US built LNG ship, before the end of Trump’s presidential term.