Debt and Monetary Dynamics of Developed vs Developing Nations: Lessons of Singapore and Reflections on Economic Strategies for Kenya and other Developing Nations

It’s fascinating to learn that Singapore’s debt primarily finances long-term infrastructure projects and boosts liquidity in the bond market, rather than covering budget deficits like many other countries, both developed and developing.

I came across a video that discusses Singapore’s so-called high foreign debt. Interestingly, this debt stems from foreign deposits in Singapore’s robust and high-quality banking system, rather than the usual government debt denominated in foreign currency, which plagues many developing countries. This often leads to economic downturns and hyperinflation if not managed properly. Remarkably, the video highlights that Singapore has almost zero government foreign debt, which is impressive but expected for a nation like Singapore.

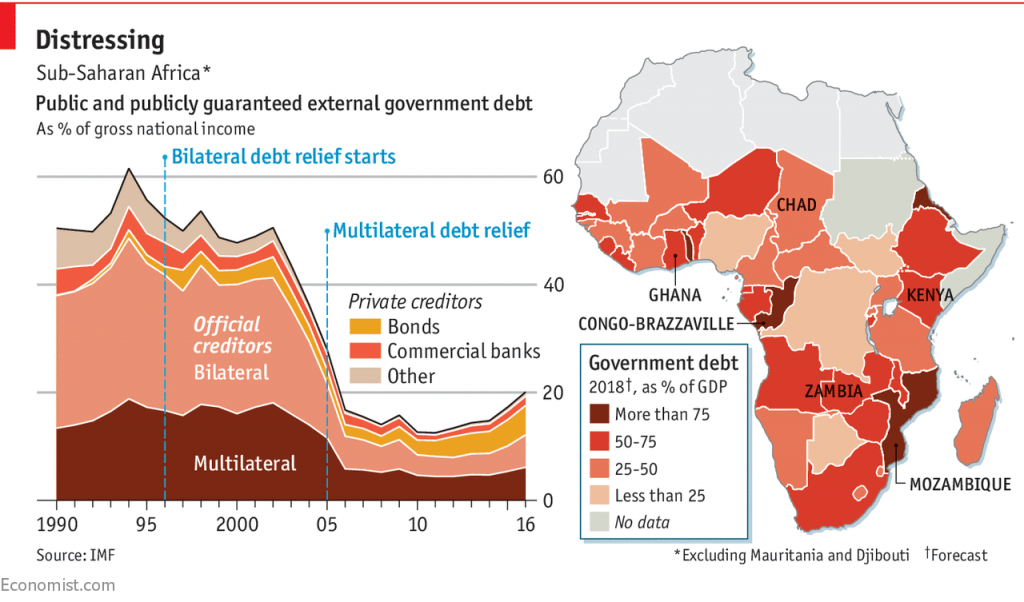

The real threat to economies and currencies in developing nations, especially frontier markets in Africa, is not local debt denominated in local currencies but foreign debt denominated in currencies like the USD or EUR.

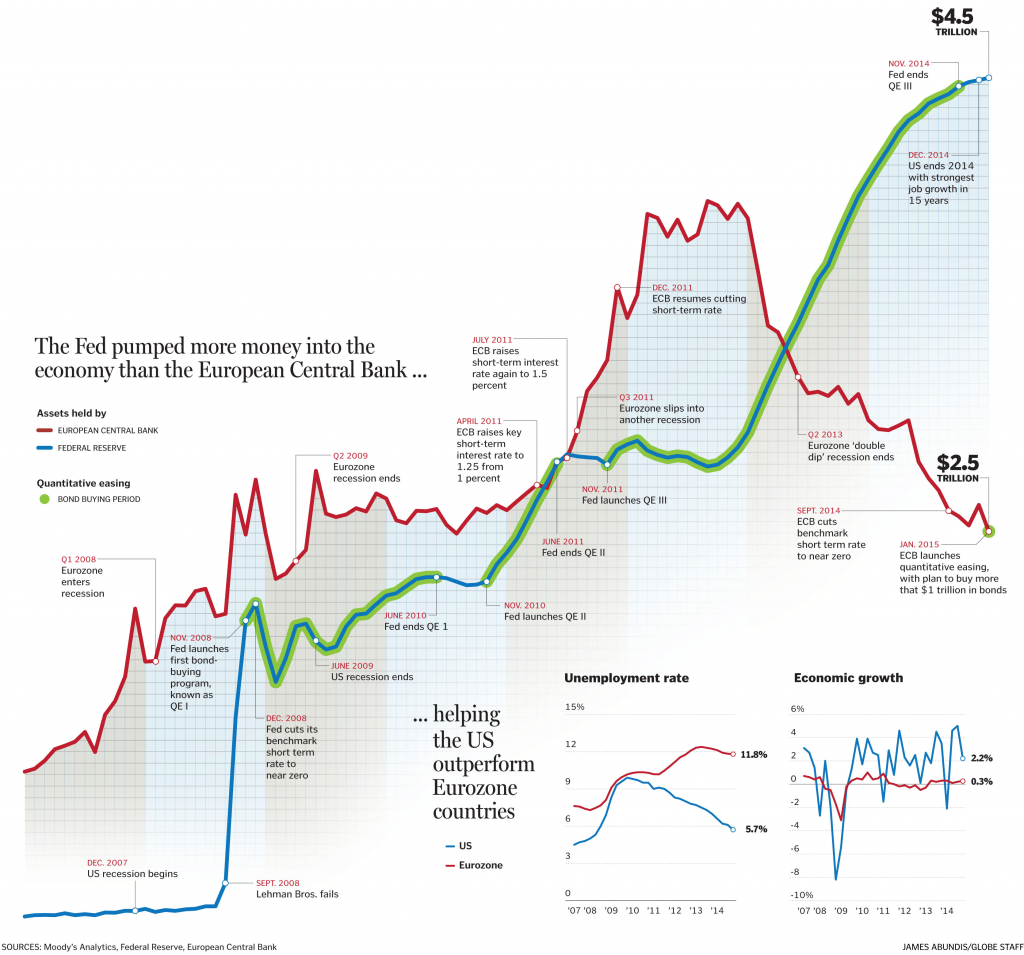

Developed countries can sustain prolonged debt periods and extensive money printing because their debts are in their own currencies. For example, the Quantitative Easing (QE) programs in the US, UK, Eurozone, and Japan are possible because these nations are the dominant players in the global monetary system—they essentially “own the casino” and can keep their economic models running without immediate catastrophic inflation. Due to their hegemony, their debt retains very high demand both locally and globally despite engaging in reckless, profligate monetary and debt expansion. One only has to remember that during the Covid pandemic, the US Federal Reserve embarked on an unprecedented monetary expansion “printing trillions” yet the USD rose sharply globally and especially against African frontier market currencies that never engaged in as much monetary expansion as the USA.

In contrast, developing nations, particularly in Africa, cannot afford such expansive monetary policies. If we were to implement aggressive monetary growth on the scale of the developed world(African nations simply cannot conduct QE operations like the first world), we would likely face almost instant hyperinflation. While our central banks also print money to service local debt during times of debt distress, this is generally sustainable because the debt is in local currency and the monetary expansion is very modest. However, we must be cautious not to overdo it, as demand for our local debt isn’t very high, and excessive money printing could lead investors, many of whom are foreign, to quickly sell off bonds leading to yield spikes and making it even more challenging for African nations to service the debt.

As a consequence, despite the rampant corruption and theft from African governments and central bankers, they implicitly know they cannot turn on the money printing spigots to full blast to pay ballooning debt lest they hyperinflate and face a revolt that could depose them from power. Thus, it enforces monetary discipline which is beneficial as it prevents asset bubbles from cheap money that periodically violently burst like in the developed world.

The real challenge is managing foreign debt, especially when it’s denominated in USD. Our governments cannot simply print money to repay this debt because doing so would devalue our currencies against the USD, requiring even more taxing and printing, potentially leading to hyperinflation if poorly handled.

However, it’s not all doom and gloom. Africa faces many challenges, which the developed world often exaggerates, leading to a narrative that we are constantly in crisis. This isn’t the case for all countries or at all times. I believe this video effectively summarizes both the strengths and difficulties faced by my country in managing its economic policies.