Russia is strangling China-Europe railway freight and Chinese automotive imports

On October 15, 2024, Russia issued the Directive No. 1374, which expanded the list of banned transit goods banned from transit through Russia, focusing on dual-use items—products like electronics, machinery, and certain textiles (e.g., camouflage clothing) that could have military applications.

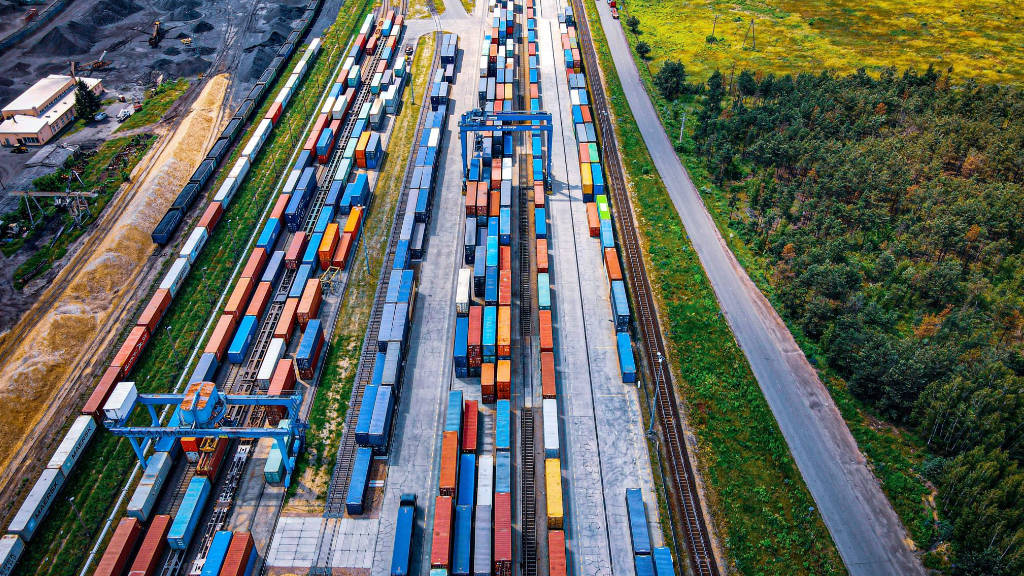

This is Russia’s efforts to control the flow of goods amid Western sanctions and the ongoing Ukraine conflict. The directive has led to a significant uptick in customs inspections at key Russian border points, such as those near Vladivostok and the Belarus-Poland border (e.g., Brest-Małaszewicze). These checks are often manual, involving physical inspections of containers, which cause delays.

Impact on Trade and Logistics

Container Detentions: Over 1,000 containers have been detained since the directive’s implementation. Some Chinese logistics firms report around 100 containers held per company, with detentions lasting weeks or months. For instance, one company noted 95% of detained containers were Chinese-owned.

Pre-directive, ~5% of containers were inspected; now, estimates suggest 20-30% face checks, with some routes reporting up to 50%.

Documentation Issues: Many detentions result from incomplete or inaccurate paperwork. Chinese shippers, accustomed to less stringent checks, face rejections for minor errors, such as missing Russian translations or incorrect product descriptions.

Customs Bottlenecks: Russian customs lack the capacity for rapid inspections, leading to backlogs. For example, at Brest-Małaszewicze, inspection facilities are overwhelmed, with only a fraction of containers processed daily.

Delays and Costs: Inspections have led to delays of 2-4 weeks at borders. Russian customs charge fees for detained containers, ranging from $5,000 to over $10,000 per container, depending on duration and contents. Additional costs arise from rerouting or storage, with some firms reporting $1,000-$2,000 per container in extra expenses.

Rail freight rates have risen to $7,000-$10,000 per TEU, compared to $5,000-$7,000 in early 2024.

Railway Congestion: Delays have caused congestion on key routes like the Trans-Siberian Railway and the China-Russia-Europe corridor, reducing train turnaround times and increasing freight rates by 10-15% in some cases.

Impact on Trade: The China-Europe Railway Express, a key Belt and Road Initiative component, saw a 3.2% year-on-year drop in container shipments in November 2024. Its market share in China-Europe trade, previously around 13%, may fall to 10% due to these disruptions. In 2023, the railway handled 1.83 million TEUs (twenty-foot equivalent units), but 2024 figures are trending lower.

Responses and Alternatives

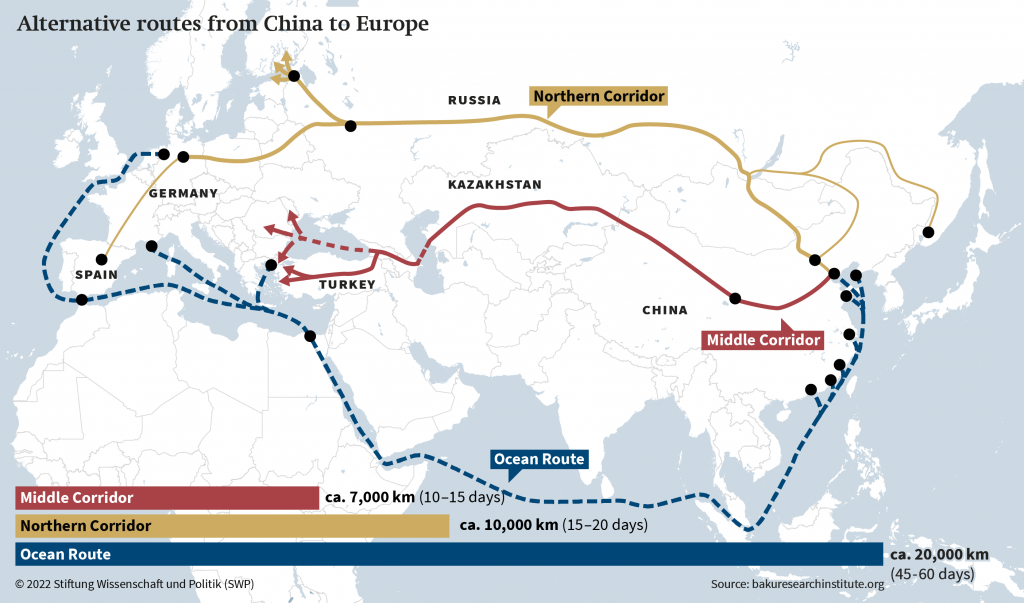

Rerouting: Shippers are exploring alternative routes to bypass Russia:

- Middle Corridor: Via Kazakhstan, the Caspian Sea, Azerbaijan, and Turkey. This route is shorter but has limited capacity (currently 300,000 TEUs annually vs. Russia’s 1.5 million) and higher costs (up to 30% more).

- Sea Freight: Some companies are reverting to sea routes via the Suez Canal, which are cheaper ($2,000-$3,000 per TEU vs. $7,000-$10,000 for rail) but slower (30-40 days vs. 15-20 days for rail).

- Southern Routes: Limited use of routes through Mongolia or Central Asia, though infrastructure constraints hinder scalability.

Chinese Mitigation: Chinese firms are improving documentation, hiring Russian customs brokers, and negotiating with Russian authorities to expedite releases. Some are also shifting to air freight for high-value goods, despite costs of $20,000-$30,000 per shipment.

Russian Proposals: Russia has suggested digital tracking systems and pre-clearance agreements with China to streamline inspections, but implementation is slow due to bureaucratic hurdles.

Russia on October 1st, 2024, raised significant recycling/utilization fee hike on Chinese vehicles.

These fees, a one-time charge for future vehicle disposal, were raised by 70-85% depending on engine size, and from January 2025, fees for Chinese carmakers add over $7,000 for vehicles with 1-2L engines and nearly $20,000 for larger vehicles, on top of a 15% import tariff. Fees are set to rise by 10-20% annually until 2030.

Effective January 1st, 2025, Russia also imposed import tariff of 20-38% on automobiles, which would impact Chinese vehicle makers most directly as China vehicles had dominated Russian market since the withdrawal of European car makers, to protect Russian domestic brands like Avtovaz.

These fees and tariffs are designed to pressure Chinese companies to establish local production facilities by making exporting from China less profitable.

China Retaliation

On October 19, 2024, Chinese Premier Li Qiang has signed a decree of the State Council to unveil regulations on export control of so-called dual use items, which will take effect on Dec. 1, 2024. This comes at the same time where the United States says Beijing is supporting Russia’s war effort in Ukraine by supplying dual use goods, including microelectronics, that can help it build weapons.

The new regulations put in place a permit system for the export of dual use goods and create a list of restricted goods. Exporters of such goods will have to disclose the ultimate user and the intended use of the exported goods.

However, given the timing of the new regulation, which is merely 4 days after Russia’s own directive, might suggest that this is a retaliation against Russia increased measures against China’s railway freight.

In March 2025, China state oil companies halted or scaled back Russian oil purchases due to concerns over dealing with the Russia producers that were sanctioned by US Biden administration on January 10, 2025, under the uncertainty of US-Russia negotiations over the Ukraine War.

DPA Notes: DPA believe that the Russian directive is a punitive action against China, for China’s unwillingness to take Russia’s side on the Ukraine War, and China’s continued sale of military-use products including drones and camouflage textiles.

The retaliations and unwillingness to commit to buying Russia oil in the face of US pressures; while Russia starting to put up protectionist measures against China – clearly shows the “perceived alliance” between the two geopolitical giants are merely a matter of mutual benefit of the times, rather than the unrestricted partnership that the two countries tried to portray in public.

Russia is also likely moving to the 2nd phase of the economic restructuring, going from the 1st phase, which focus on mitigating the impact of losing supply chain and products from Europe, by finding alternatives from other countries (mainly benefited by China) – to the 2nd phase, which is to start to develop domestic capacity to supply some of these products and technology that is currently missing in Russia (and was previously dependent on Europe or other countries).

By the 3rd phase, Russia would start to compete against China and other countries in international markets in exports in products categories that Russia previously do not have capacity in, developing/growing the export mix that is currently dominated by energy and agricultural products – in the process, exporting influence and culture around the world.

The current trade war between China and USA plays into Russia’s hands, allowing Russia leverage over China, invest in themselves and then return to the global stage as a major competitor to countries that Russia used to depend on.